Capabilities

Automated tax calculations: Calculate accurate sales tax for every invoiceUp-to-date tax rates: Automatically account for the latest tax rates and changes

Prevent tax errors: Avoid manual tax calculation errors and ensure compliance

Avalara address validation: Leverage Avalara’s built-in customer address validation

To use this integration, you need to have an Avalara account. If you don’t have an Avalara account yet, reach out to our team to make use of our Sequence & Avalara discount.

Integration setup

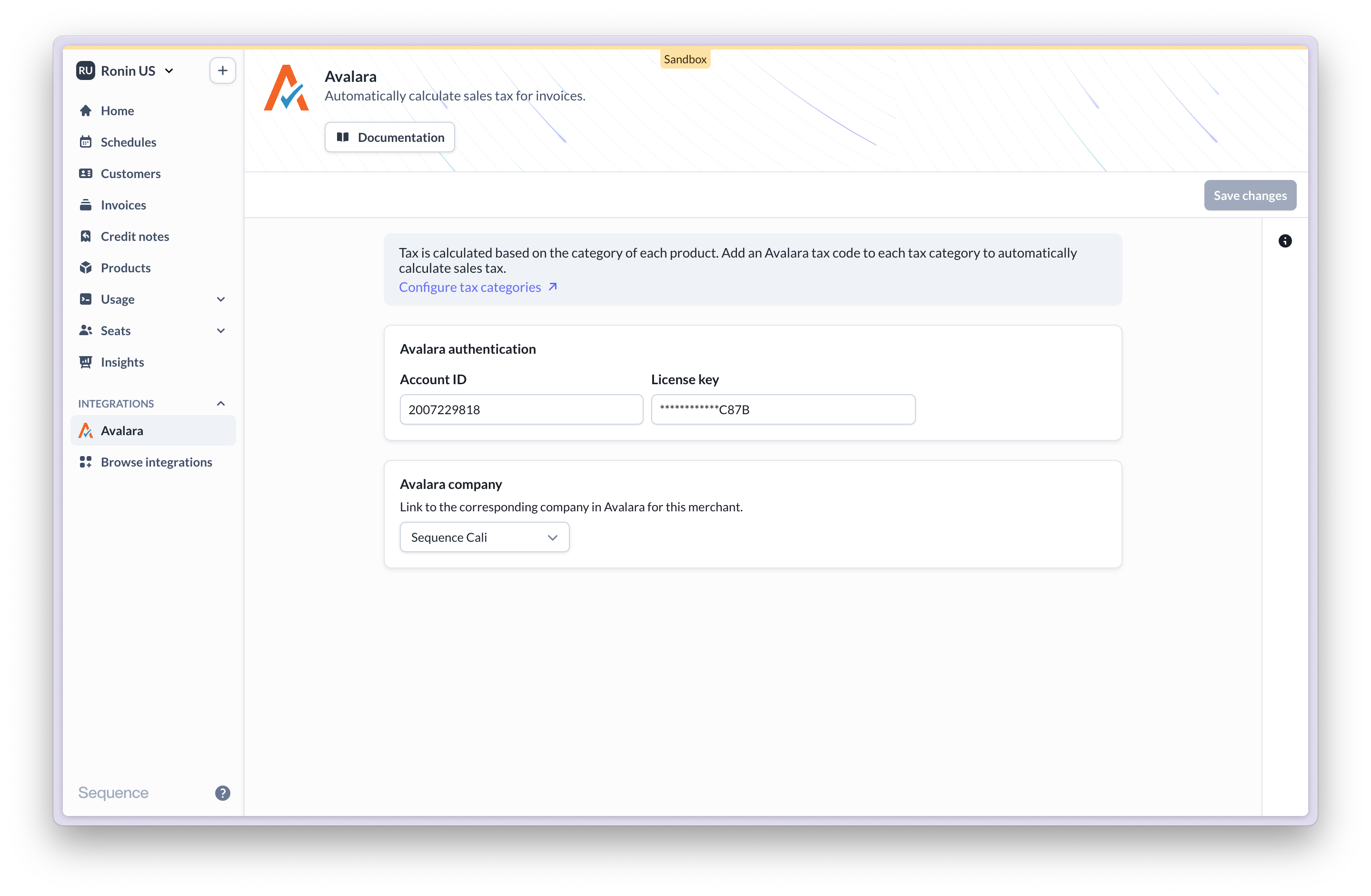

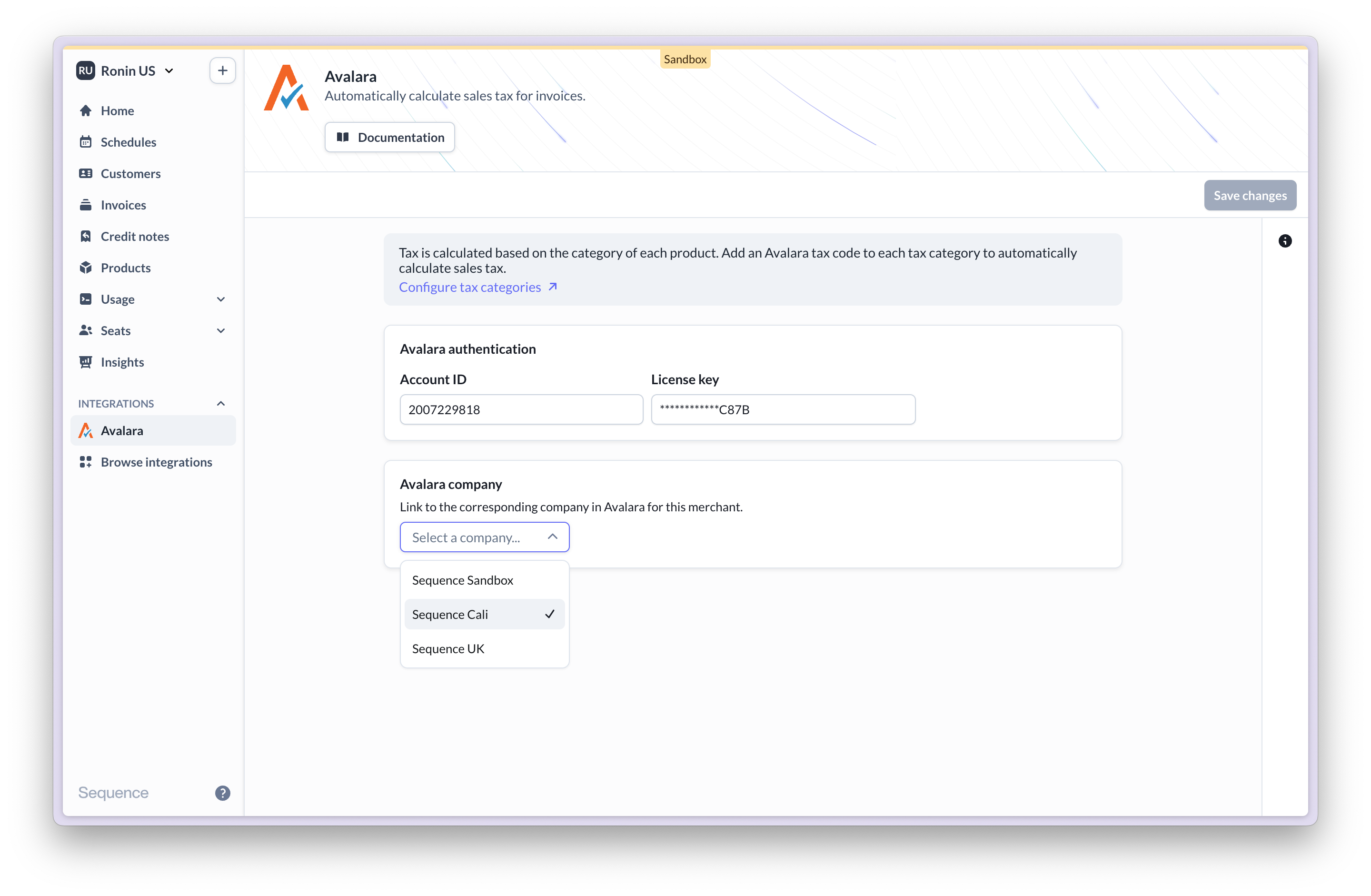

Connect to Avalara

- View integration

- Authenticate

- Select Avalara company

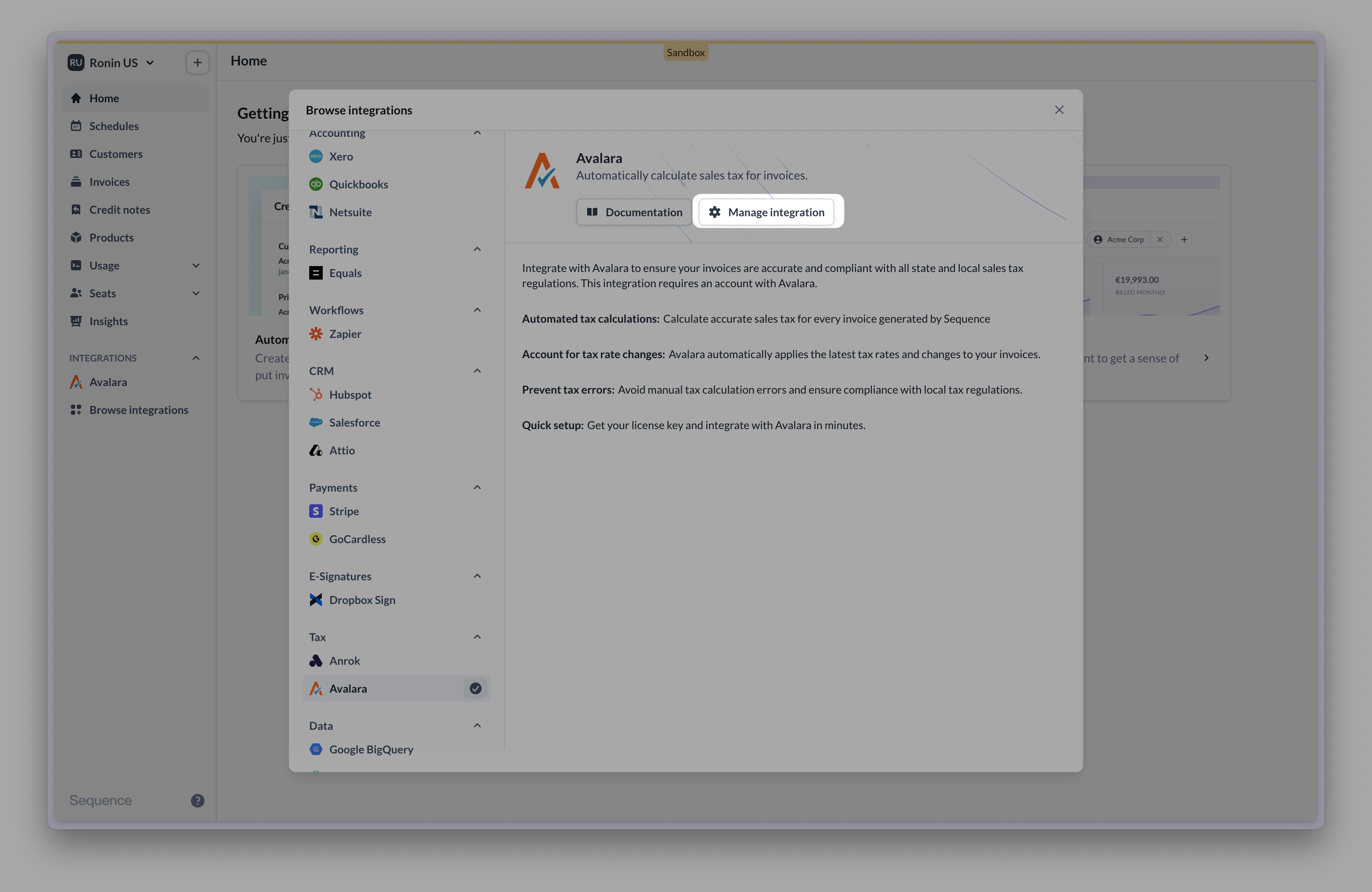

Go to Integrations, find Avalara and select “Manage integration”.

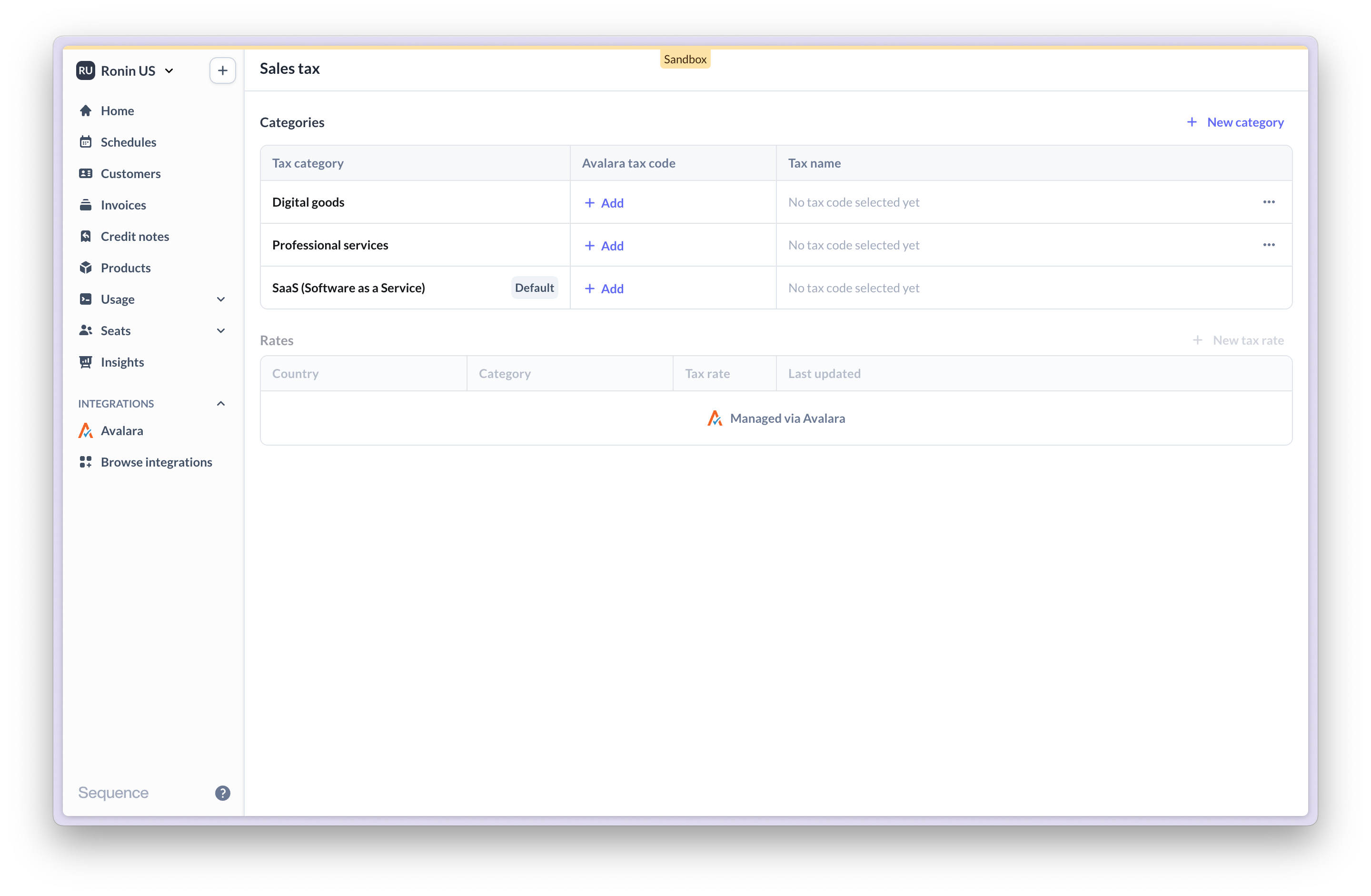

Assign Avalara tax codes

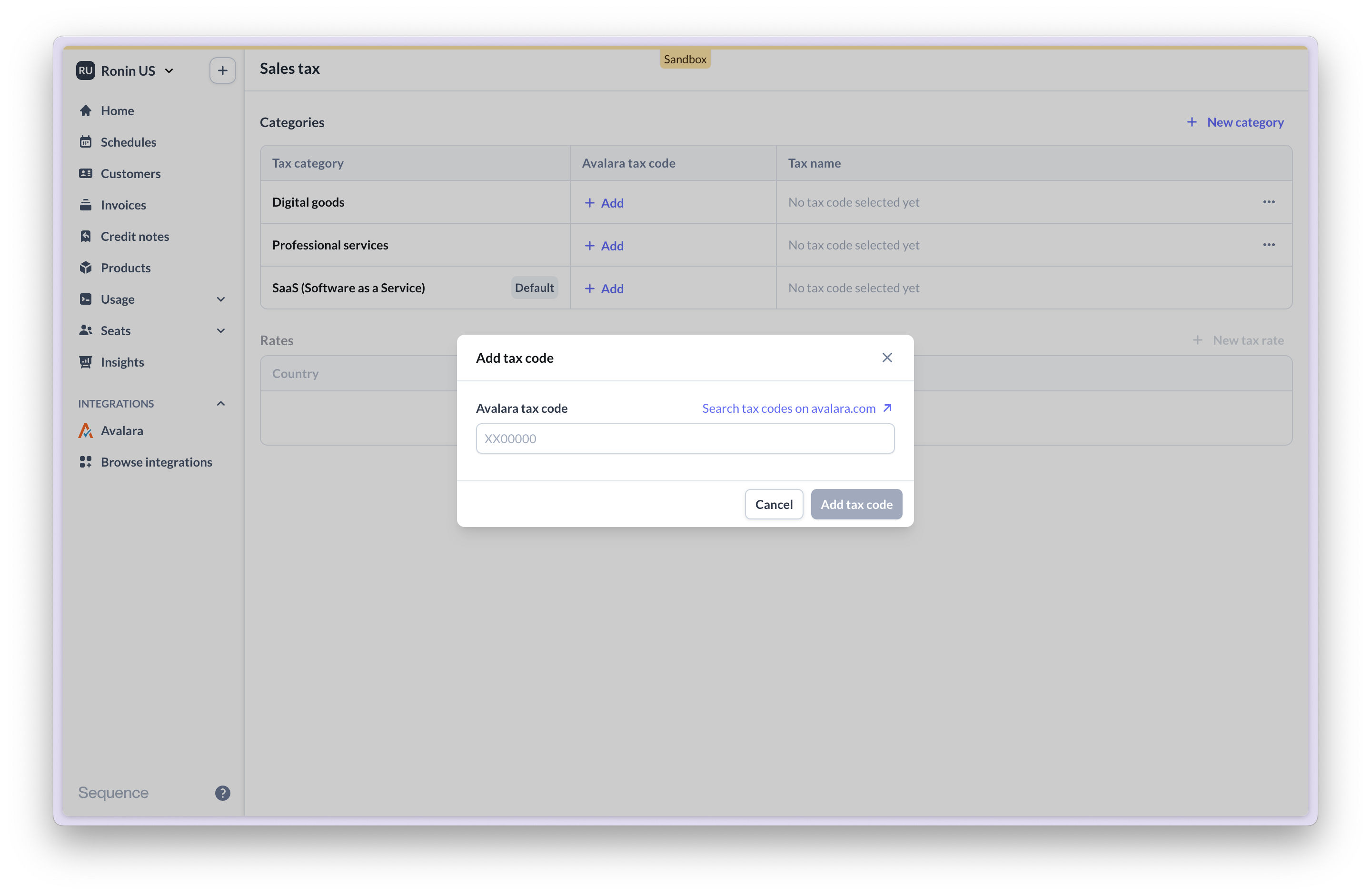

- View tax categories

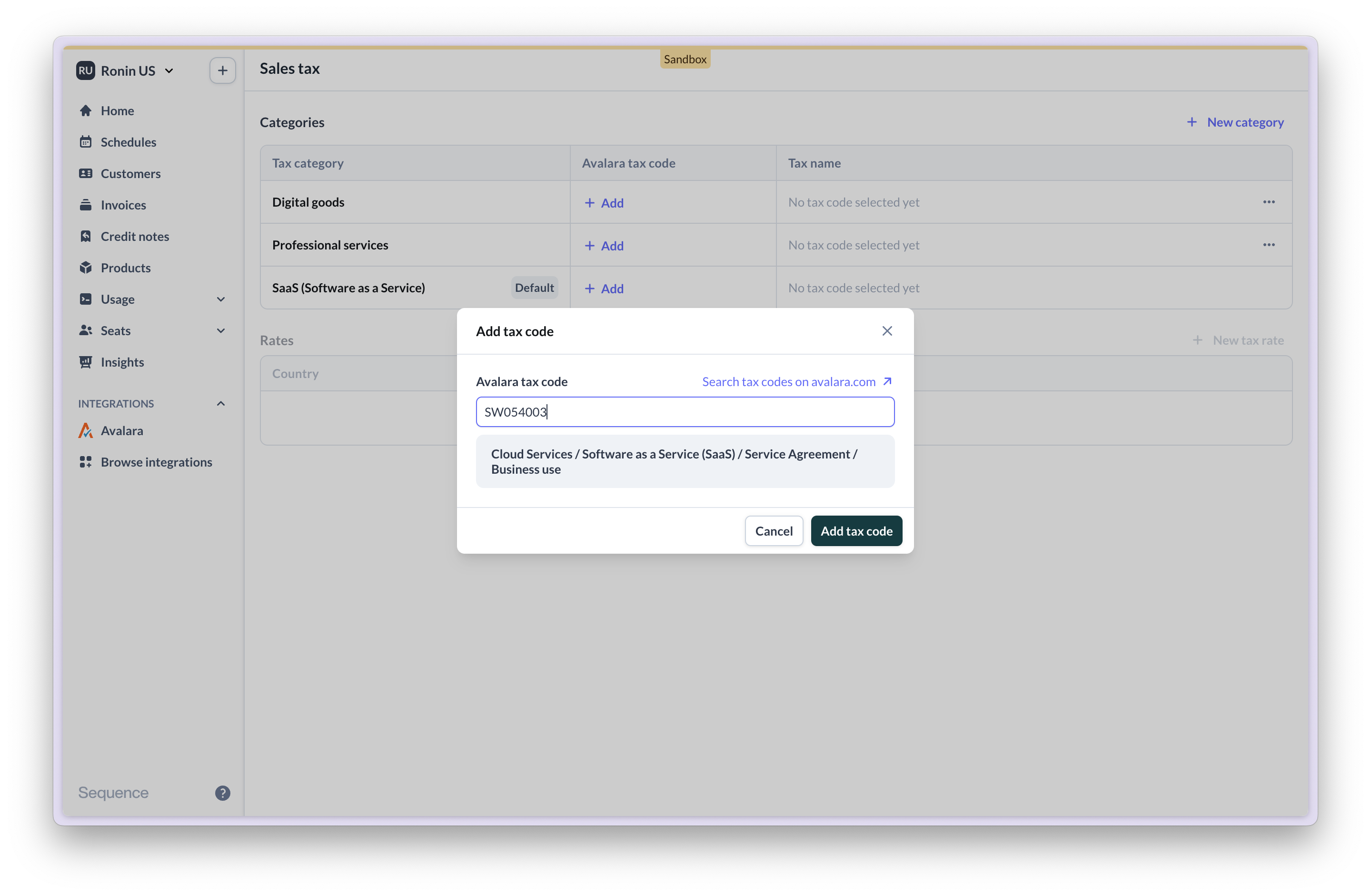

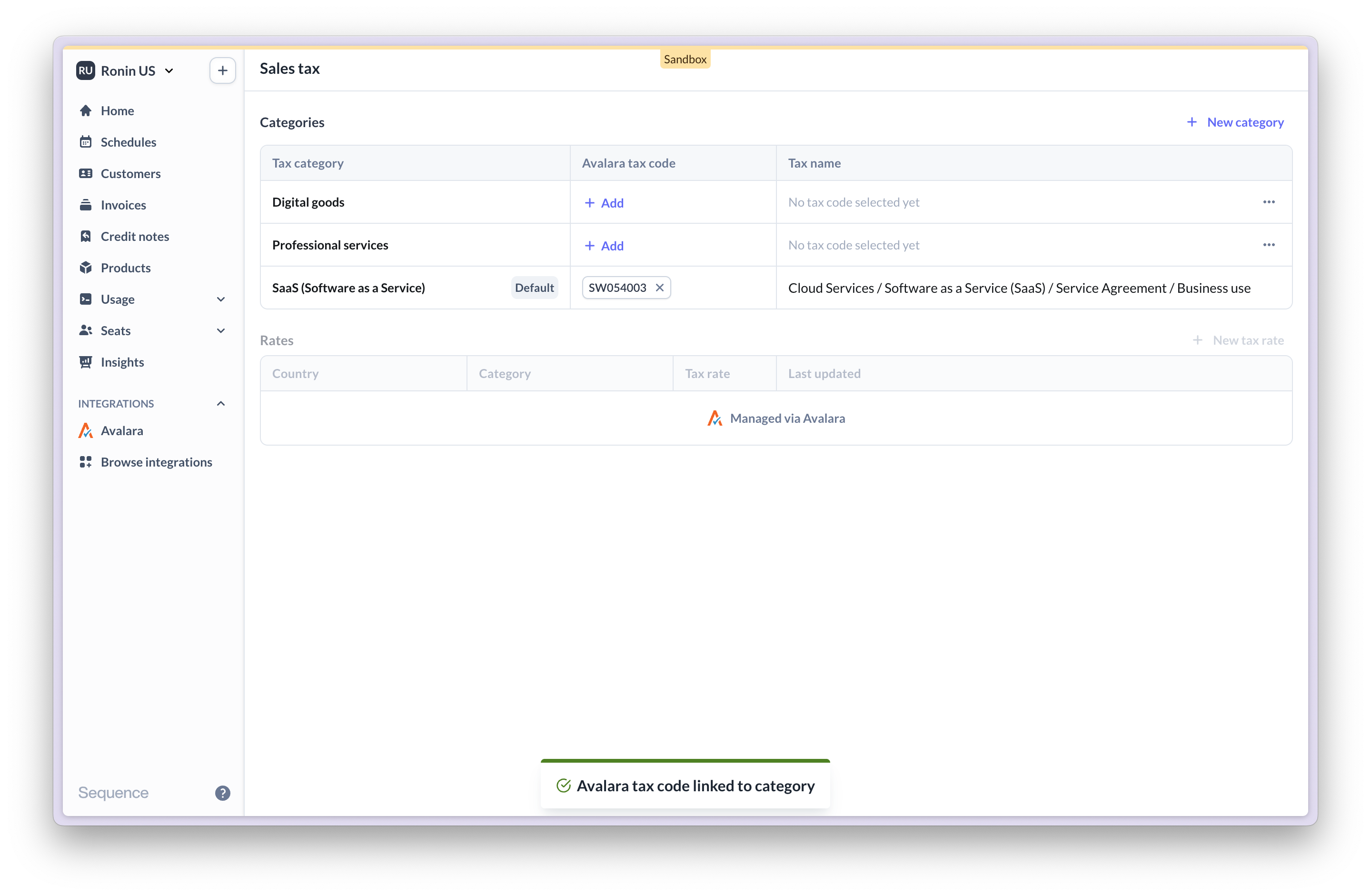

- Assign tax code

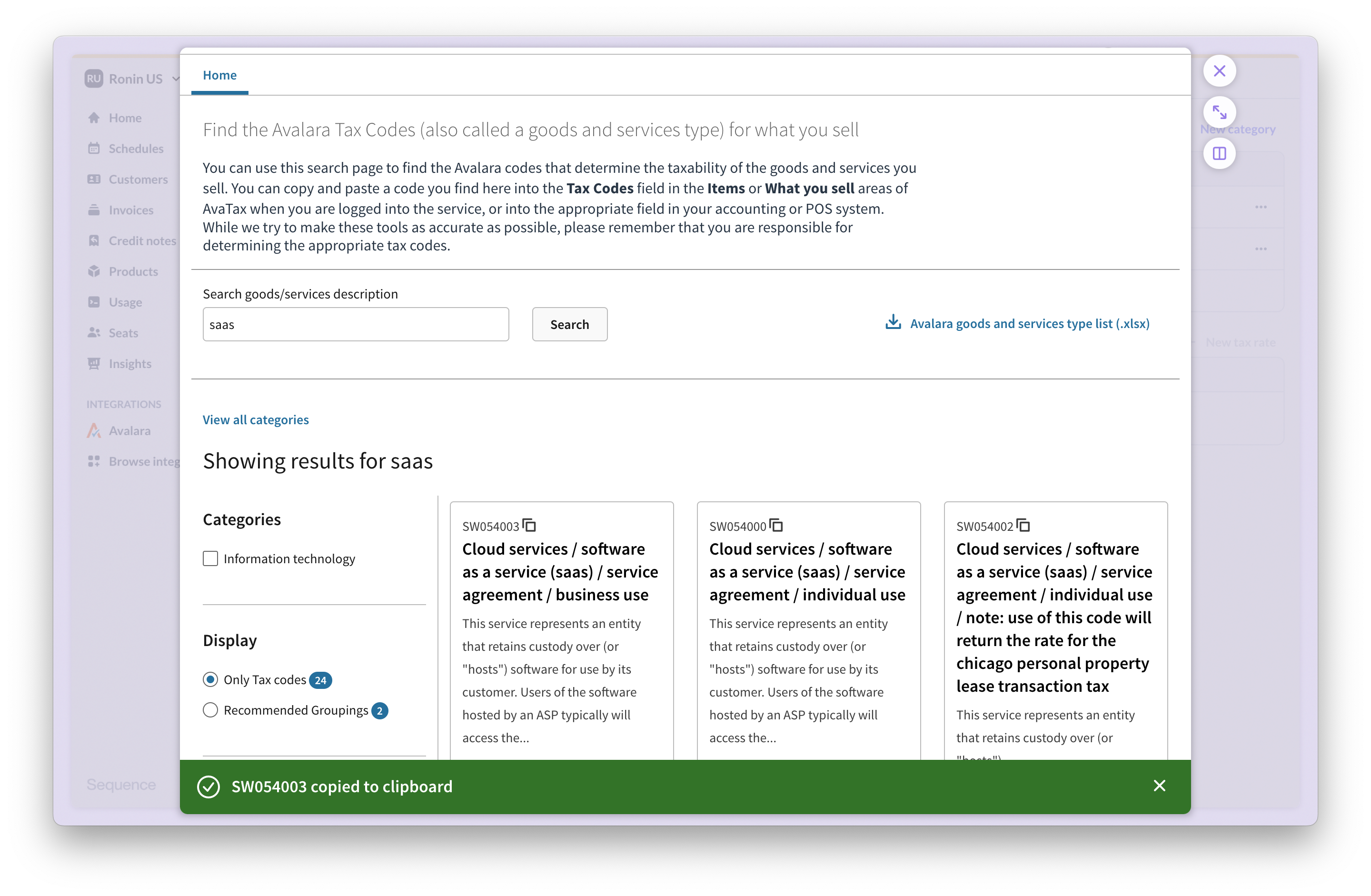

- Look up tax code

- Add tax code

Start by assigning Avalara tax codes to product tax categories in Sequence (go to Settings > Sales Tax). Once Avalara is connected, tax categories are managed via Avalara tax codes. You can no longer manage tax categories with custom rates.

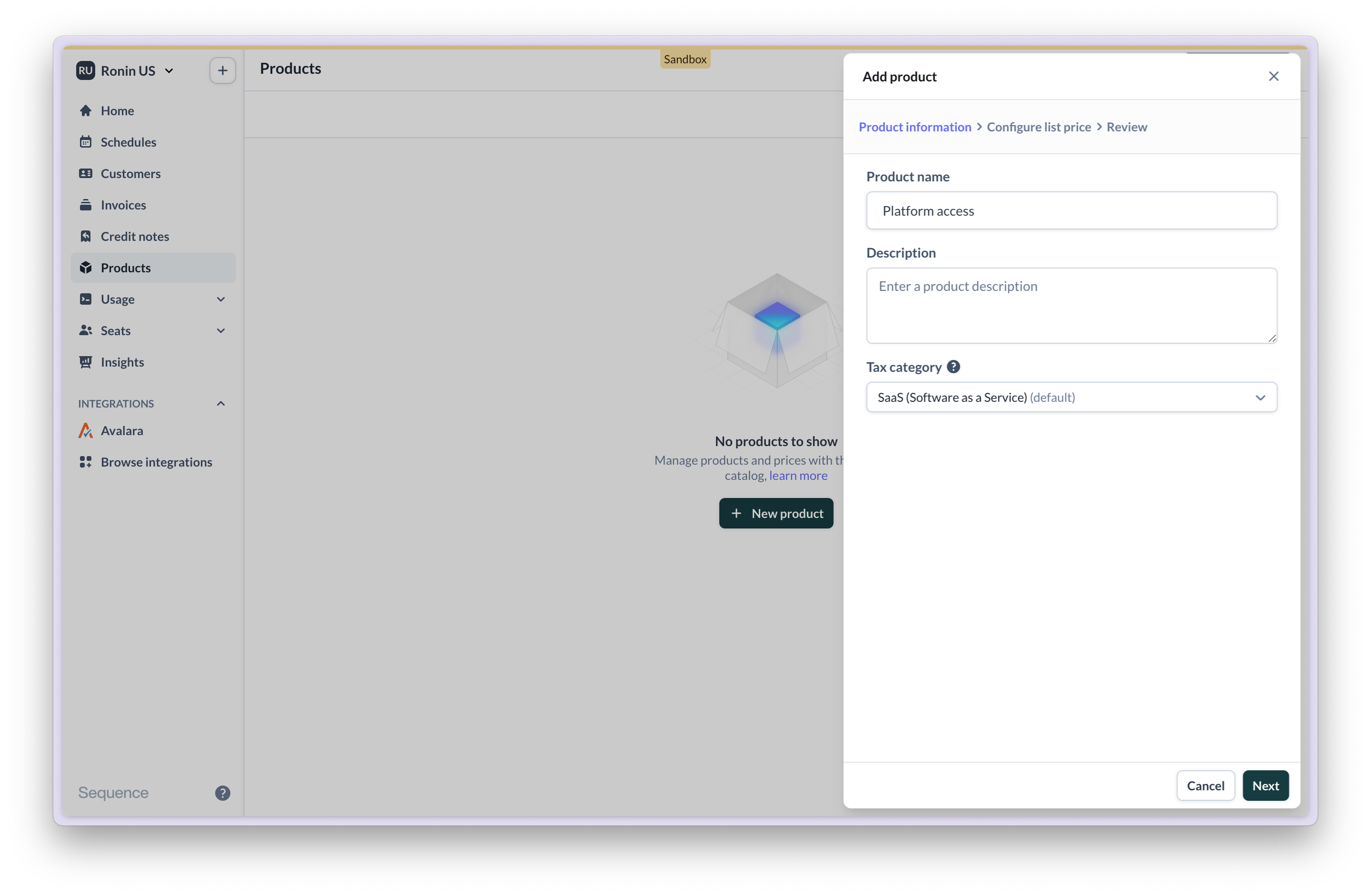

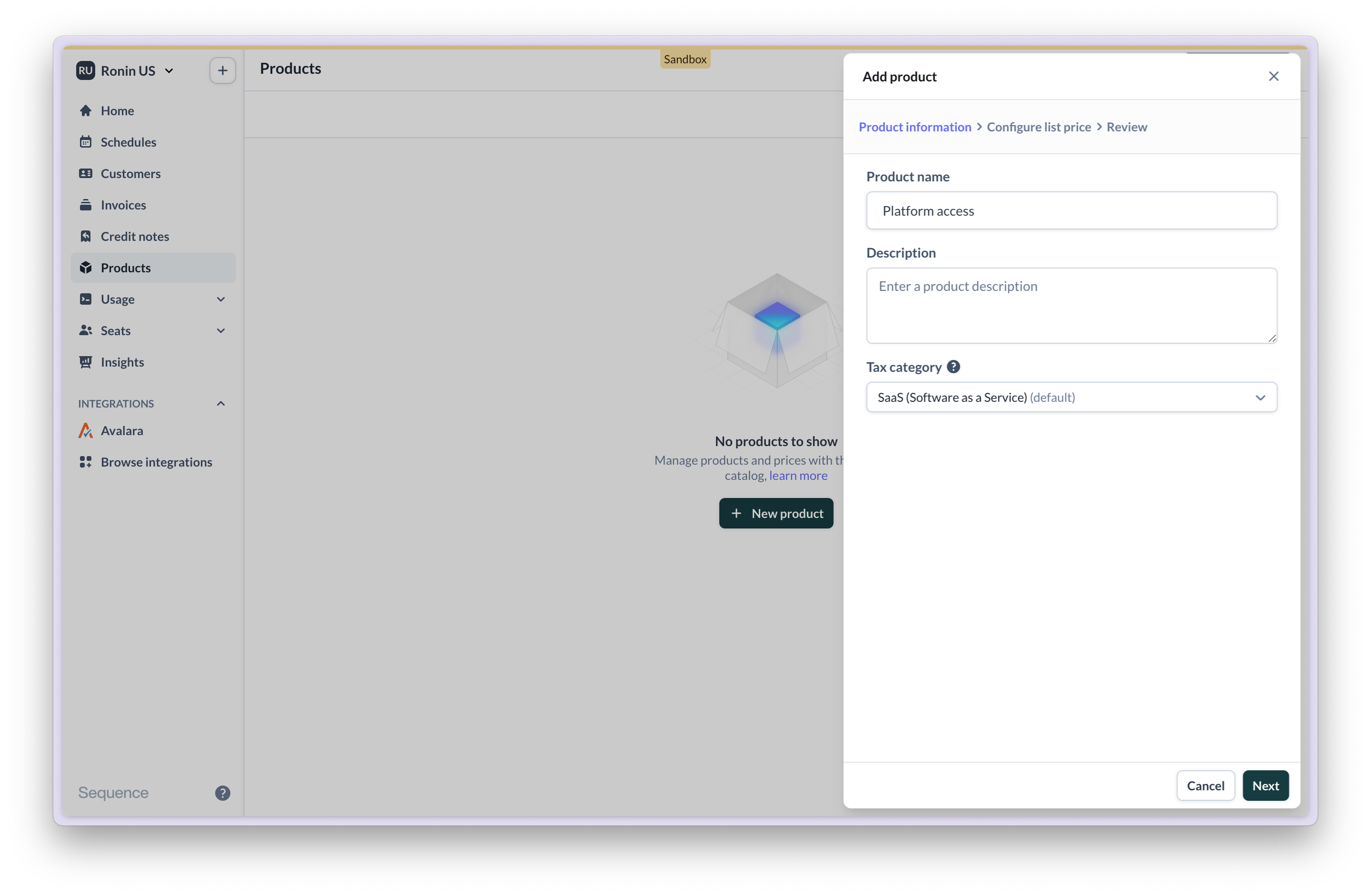

Add tax categories to products

In your product catalogue, assign product tax categories to products. In order to automatically calculate sales tax for a given product, its tax category must be mapped to an Avalara tax code.

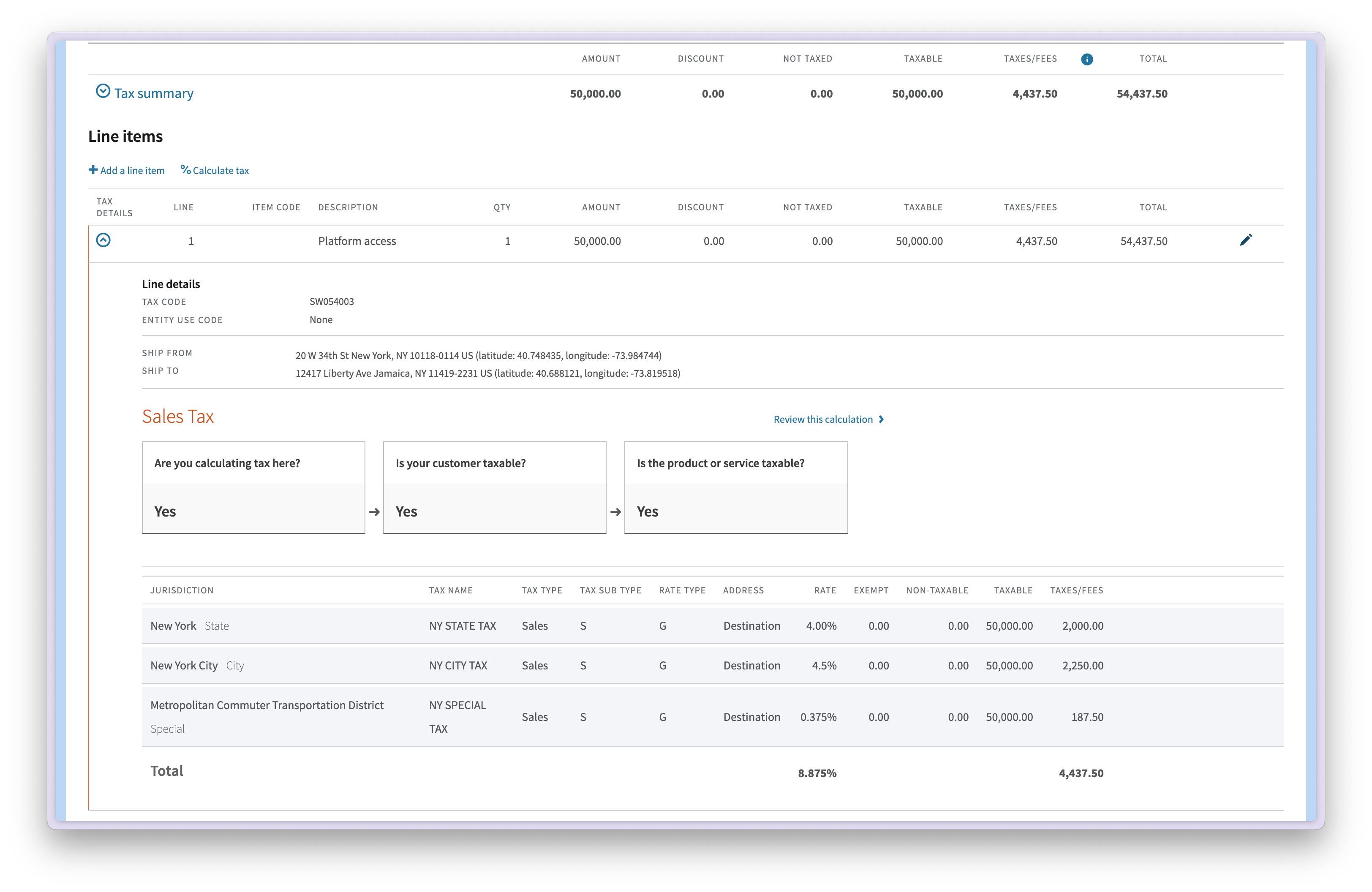

Calculating sales tax with Avalara

Once you’re connected to Avalara, Sequence will calculate sales tax for every draft invoice via Avalara. Whether and how tax is calculated depends on the following factors:- Your merchant location in Sequence (Settings > Merchant > Address)

- Your customer’s location & tax status

- Your tax configuration and tax exposure as reported to Avalara

- The Avalara tax code assigned to a sold product

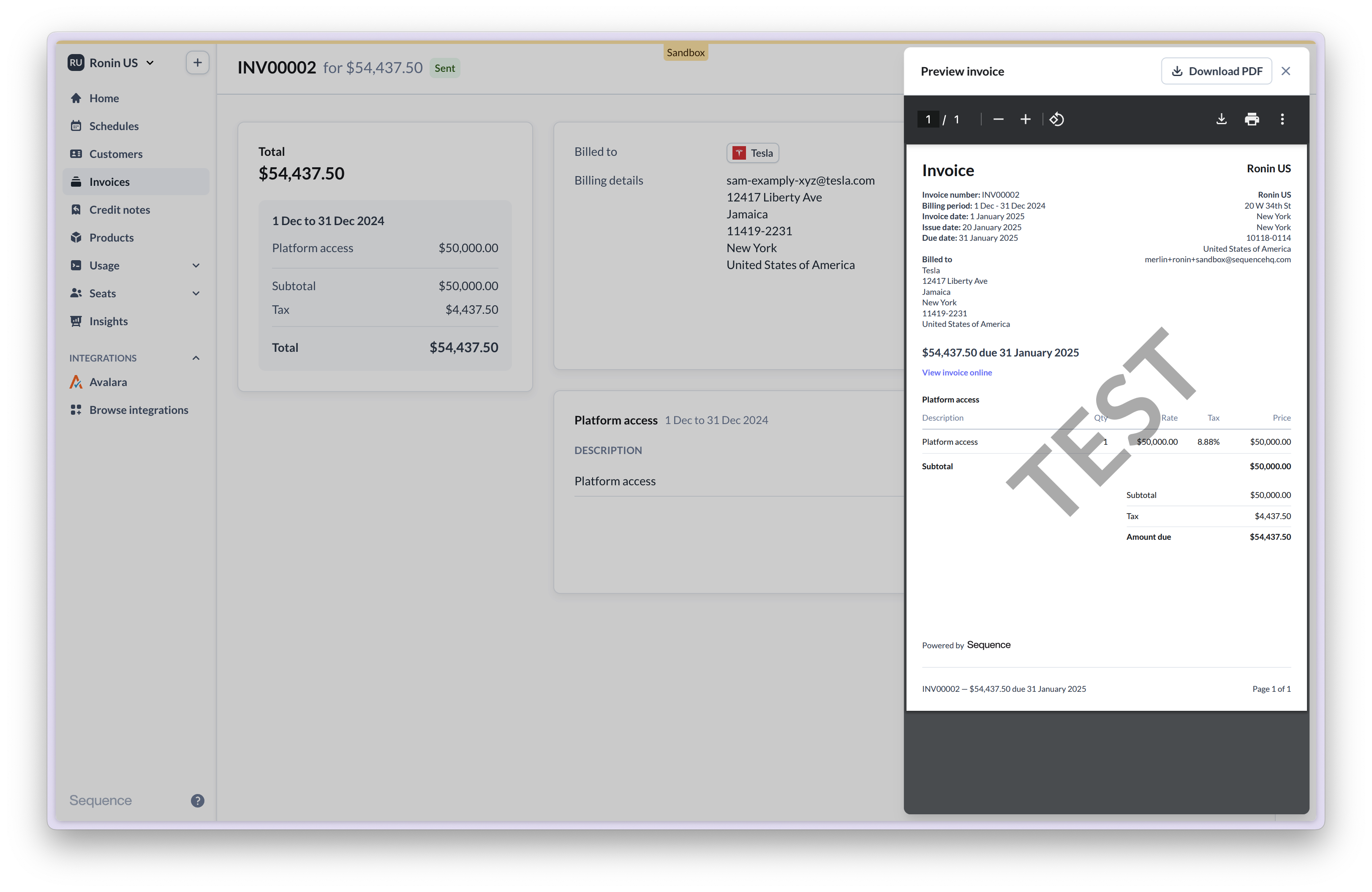

- Invoice calculation

- Invoice PDF

- Avalara tax calculator

- Corresponding transaction in Avalara

Tax is automatically calculated and added to the invoice.

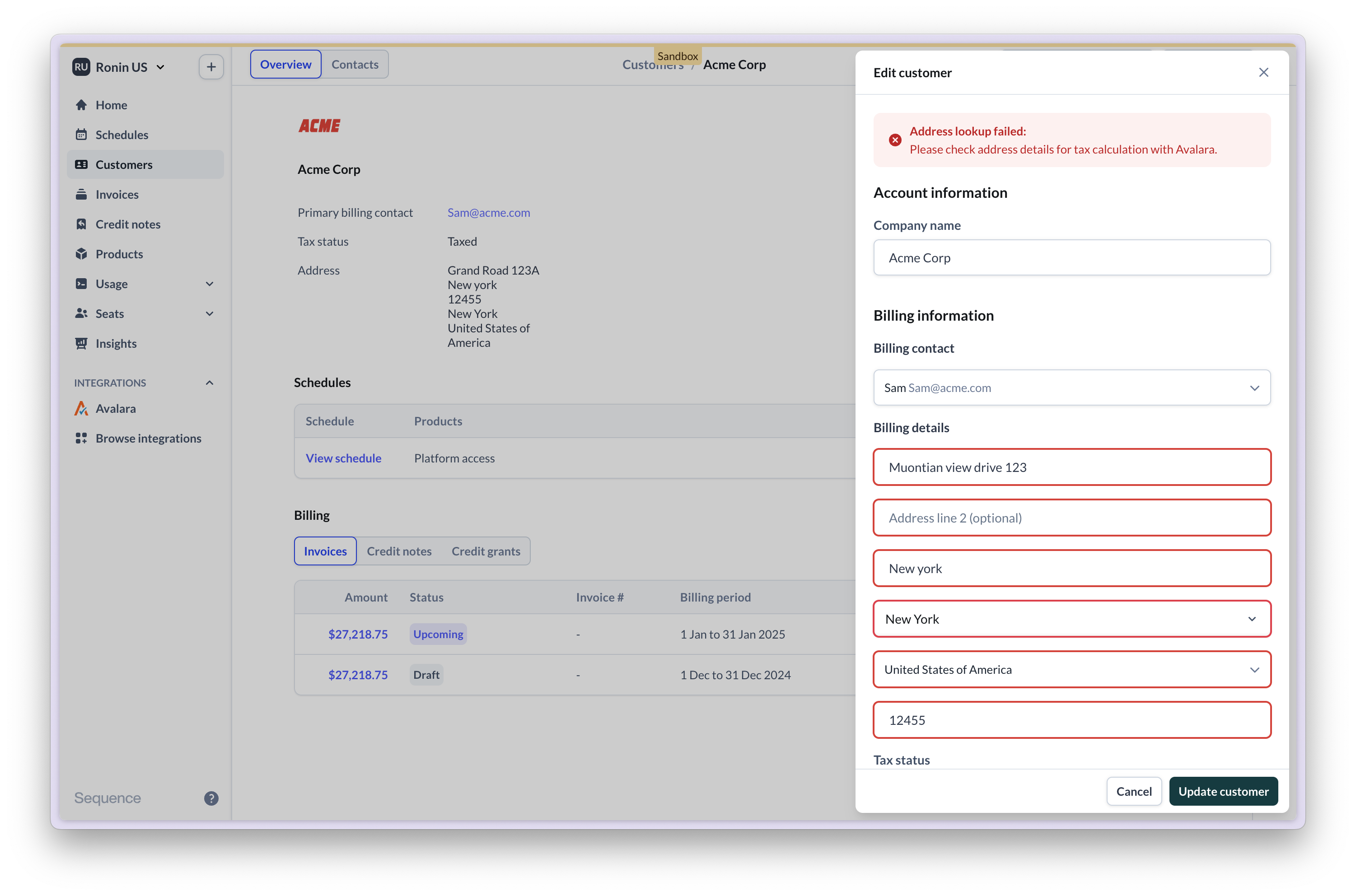

Customer address validation via Avalara

Once you’re connected to Avalara, Sequence will validate a customer’s billing address via Avalara. This is required to ensure sales tax is accurately calculated based on the customer’s locale. For customers located outside of the US, Avalara only checks the country.

Troubleshooting

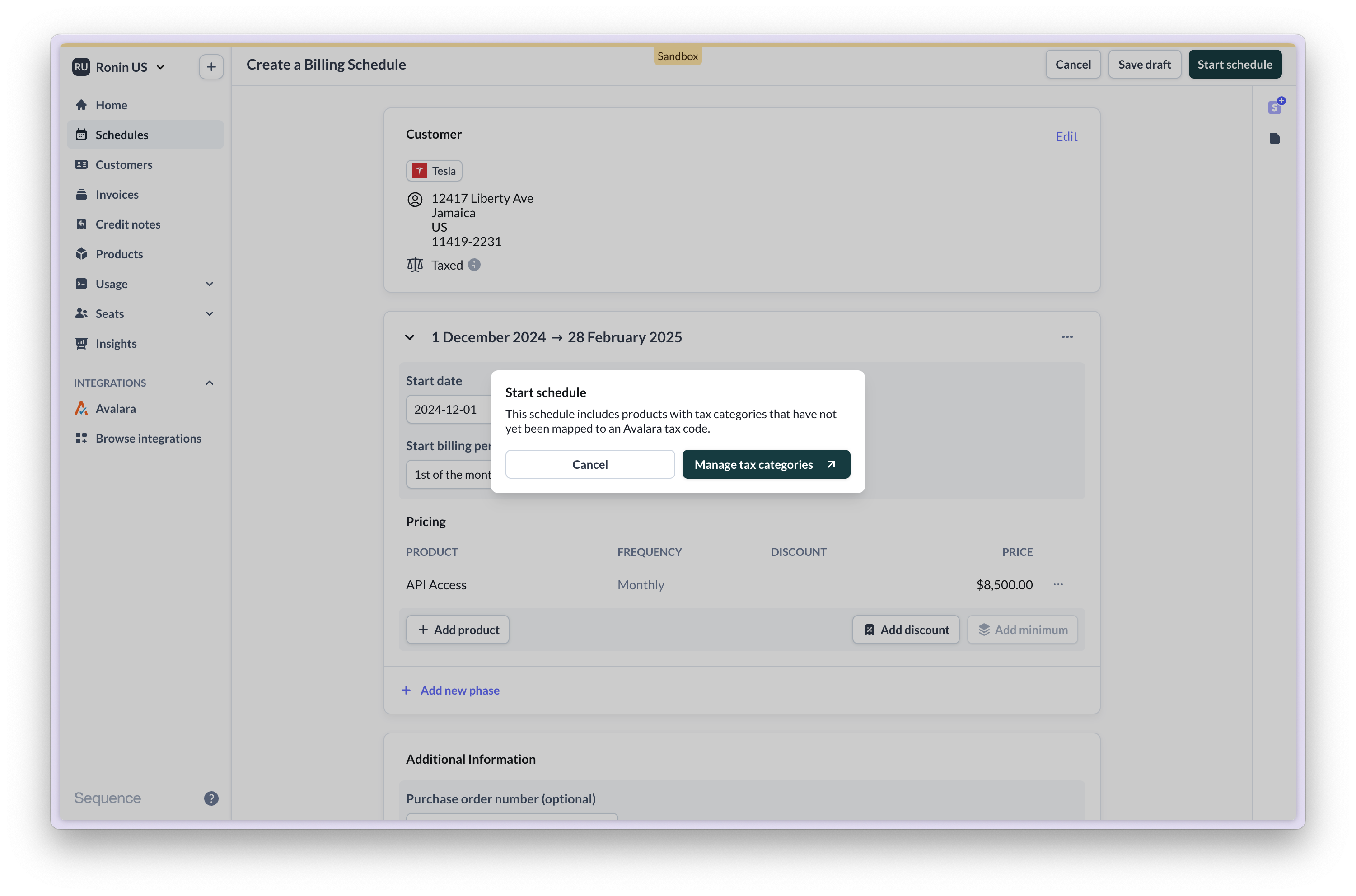

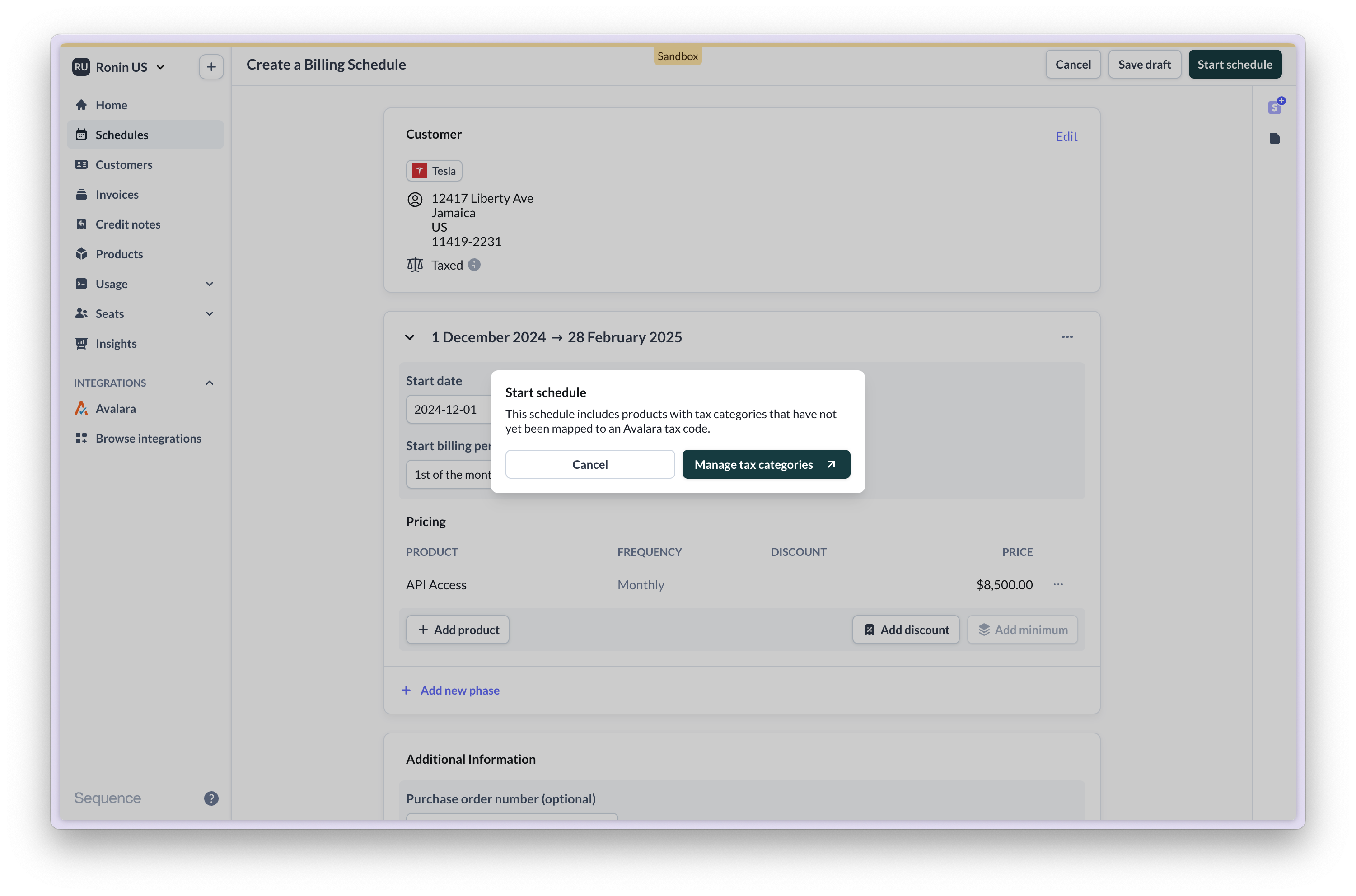

Tax categories not mapped to Avalara tax codes

Tax categories not mapped to Avalara tax codes

If a billing schedule includes products with tax categories that have not been mapped to an Avalara tax code, you will be prompted to assign a tax code.

Connecting to an Avalara Sandbox or Production account

Connecting to an Avalara Sandbox or Production account

When setting up the integration, ensure you are connecting to the right Avalara account:

- a Sequence Sandbox only connects to an Avalara Sandbox

- a Sequence Production account only connects to an Avalara Production account

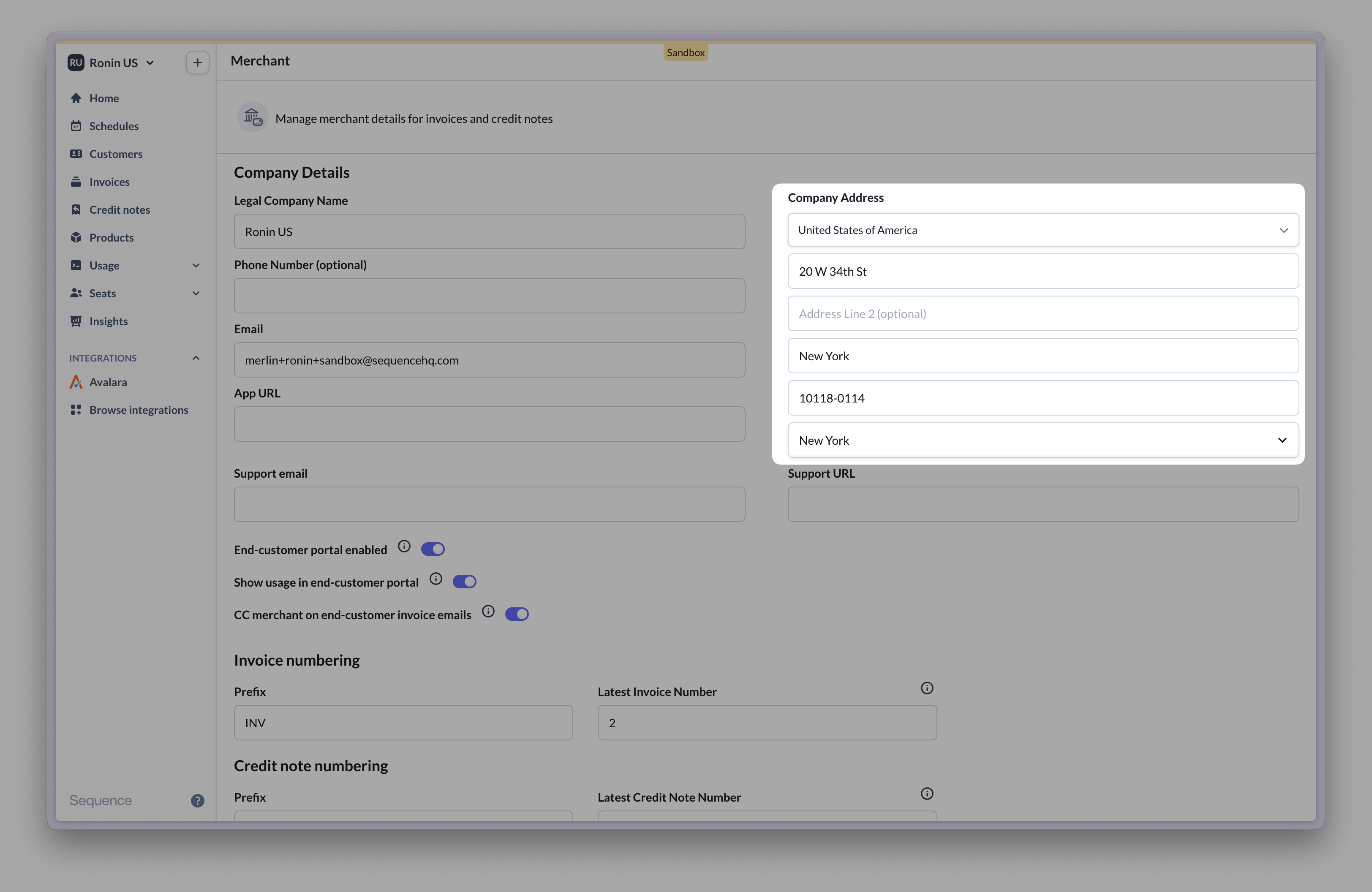

Incorrect merchant address

Incorrect merchant address

Ensure that you have correctly configured your merchant address in Sequence. This address needs to match your company’s address in Avalara.

Account country mismatch

Account country mismatch

For Avalara to successfully calculate tax, your Sequence account’s country must match your Avalara company’s country. If in doubt, reach out to our team.

Frequently asked questions (FAQ)

Do Sequence products need to be synced with Avalara?

Do Sequence products need to be synced with Avalara?

No. Sequence’s Avalara integration maps product tax categories to Avalara tax codes. When Sequence generates an invoice for a product, the assigned tax code is used to calculate tax via Avalara.

Can I use Avalara as a UK business?

Can I use Avalara as a UK business?

Yes.

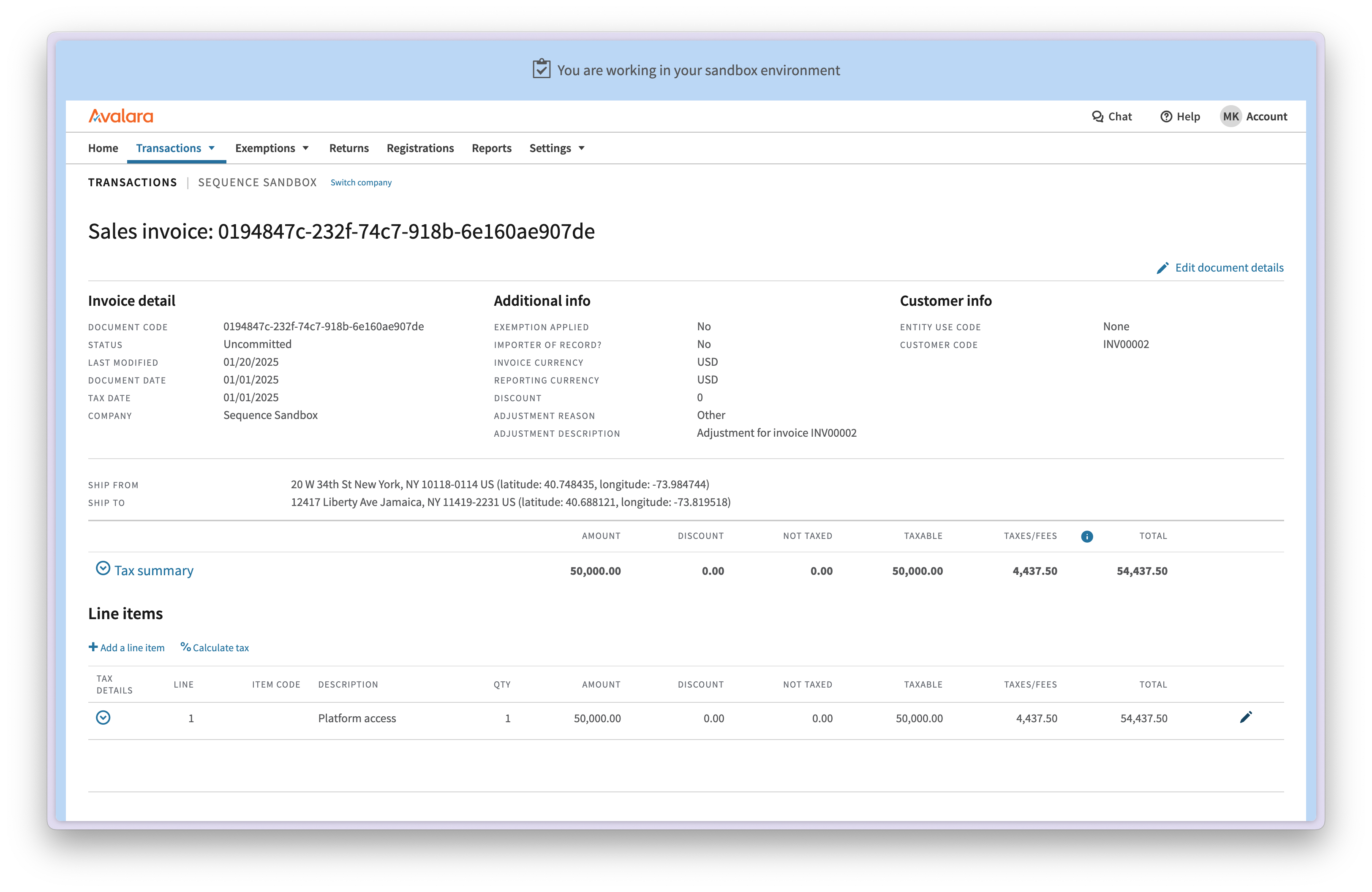

How to commit transactions in Avalara?

How to commit transactions in Avalara?

Go to Transactions and find the relevant transactions to commit. Transactions created by Sequence appear as draft. To commit transactions in bulk consider exporting and importing transactions.

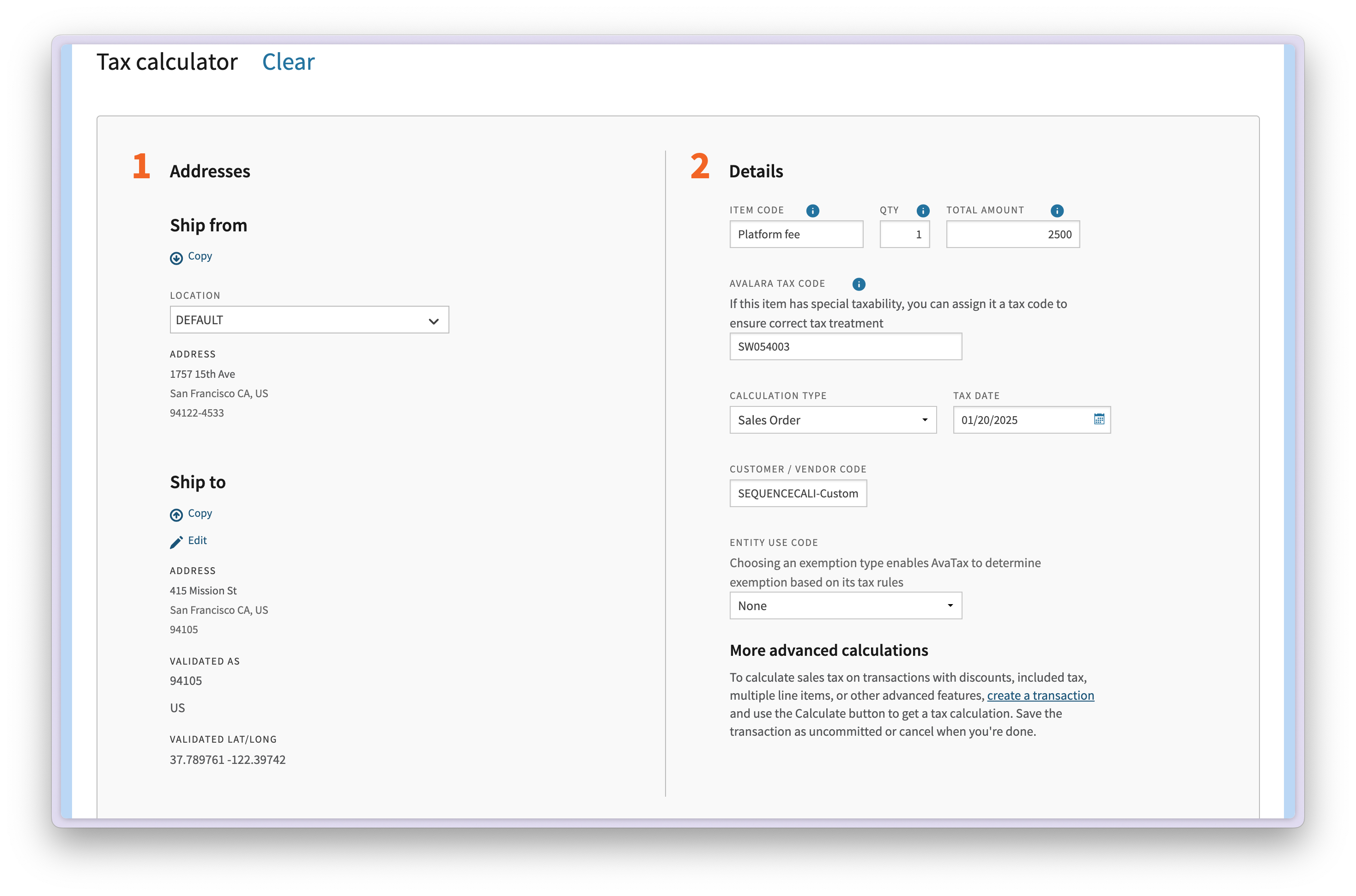

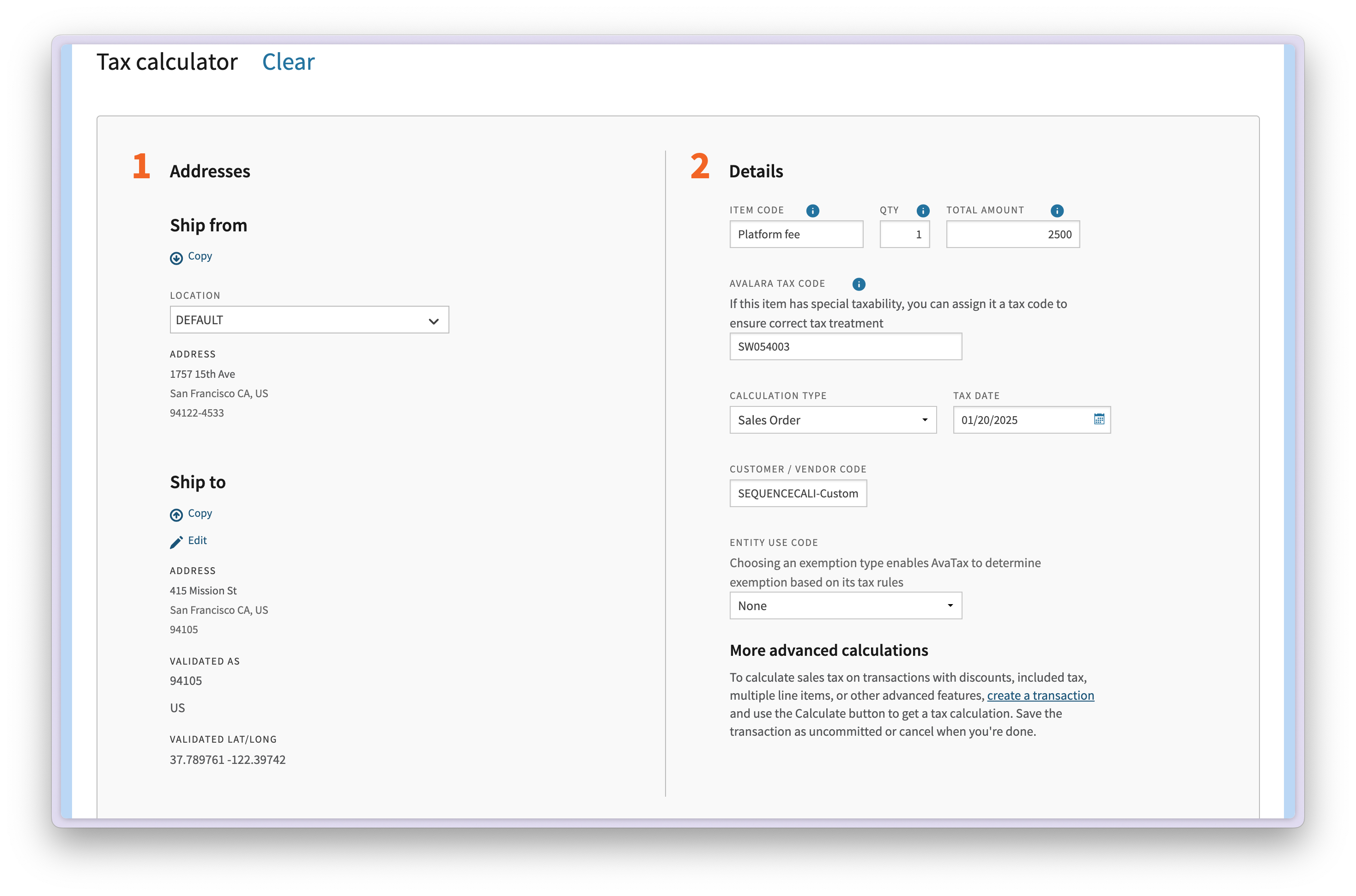

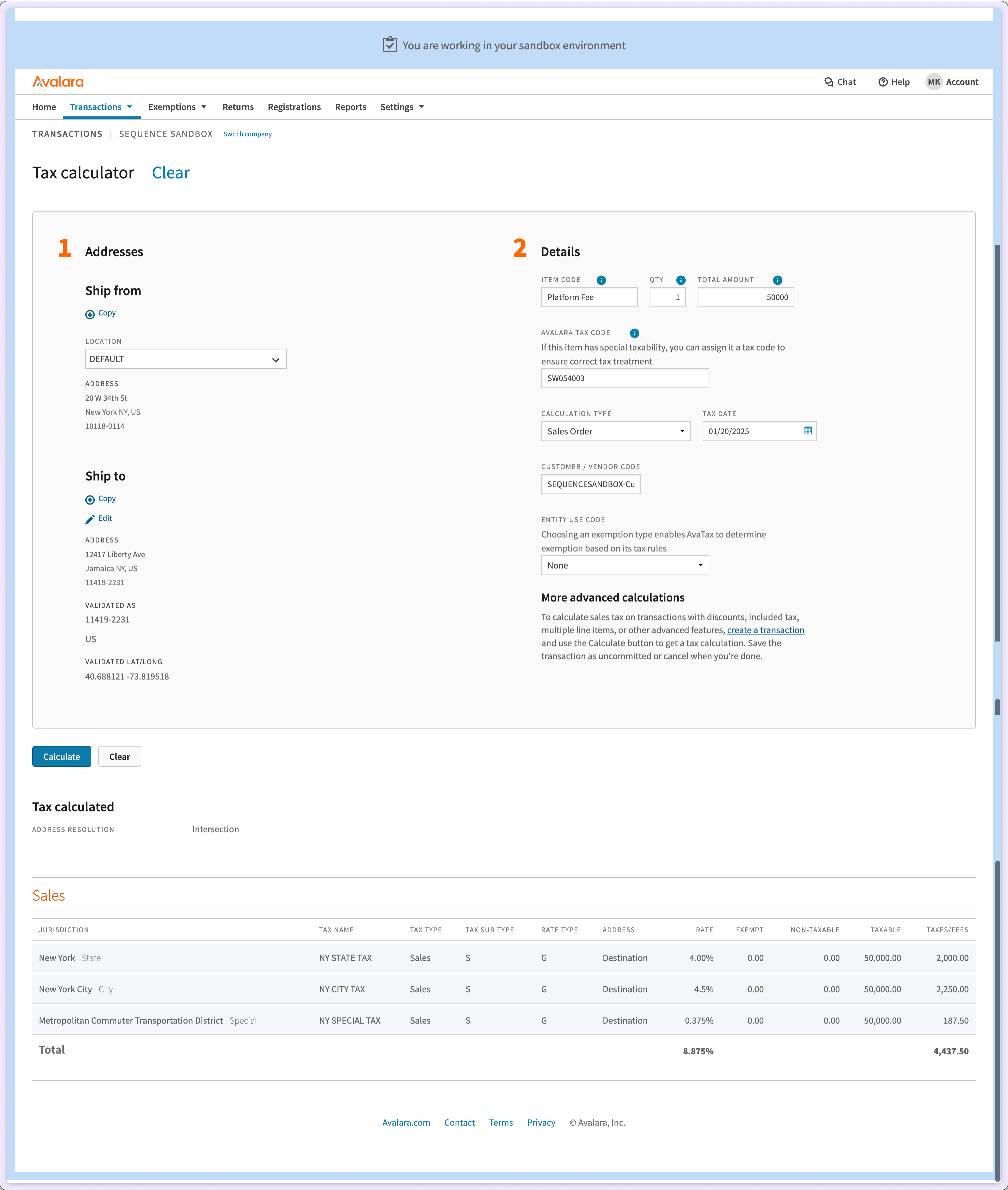

How to test sales tax calculations?

How to test sales tax calculations?

To test sales tax calculations, use the tax calculator tool from your Avalara account.

Enter your company address, customer address and item to sell to view an example calculation.