- Keep customers in sync across Sequence and QuickBooks

- Sync invoices into QuickBooks in real-time

- Automatically update the payment status of invoices reconciled in QuickBooks

- Map QuickBooks items, accounts and tax codes to Sequence for accurate categorization

Getting started

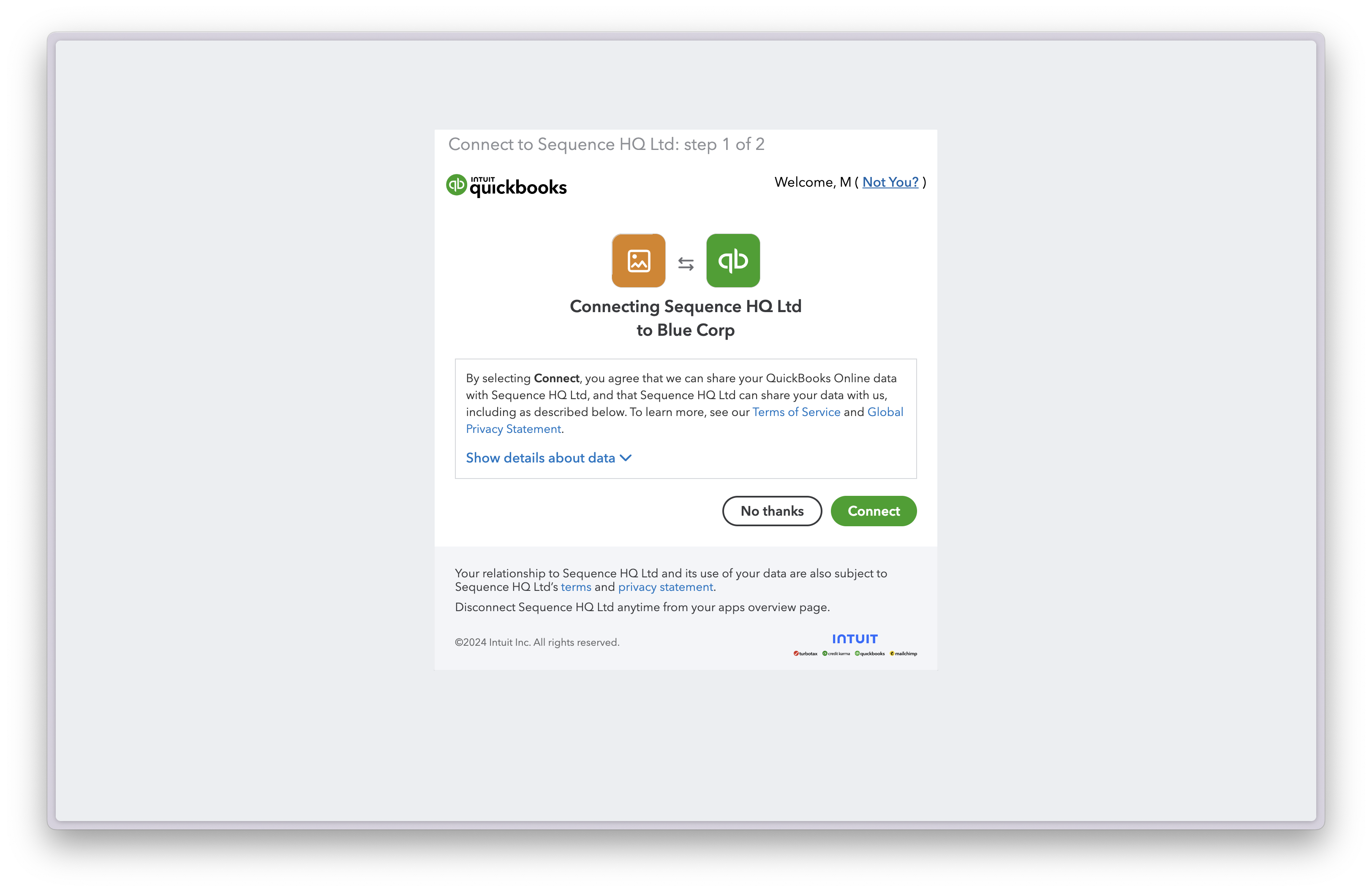

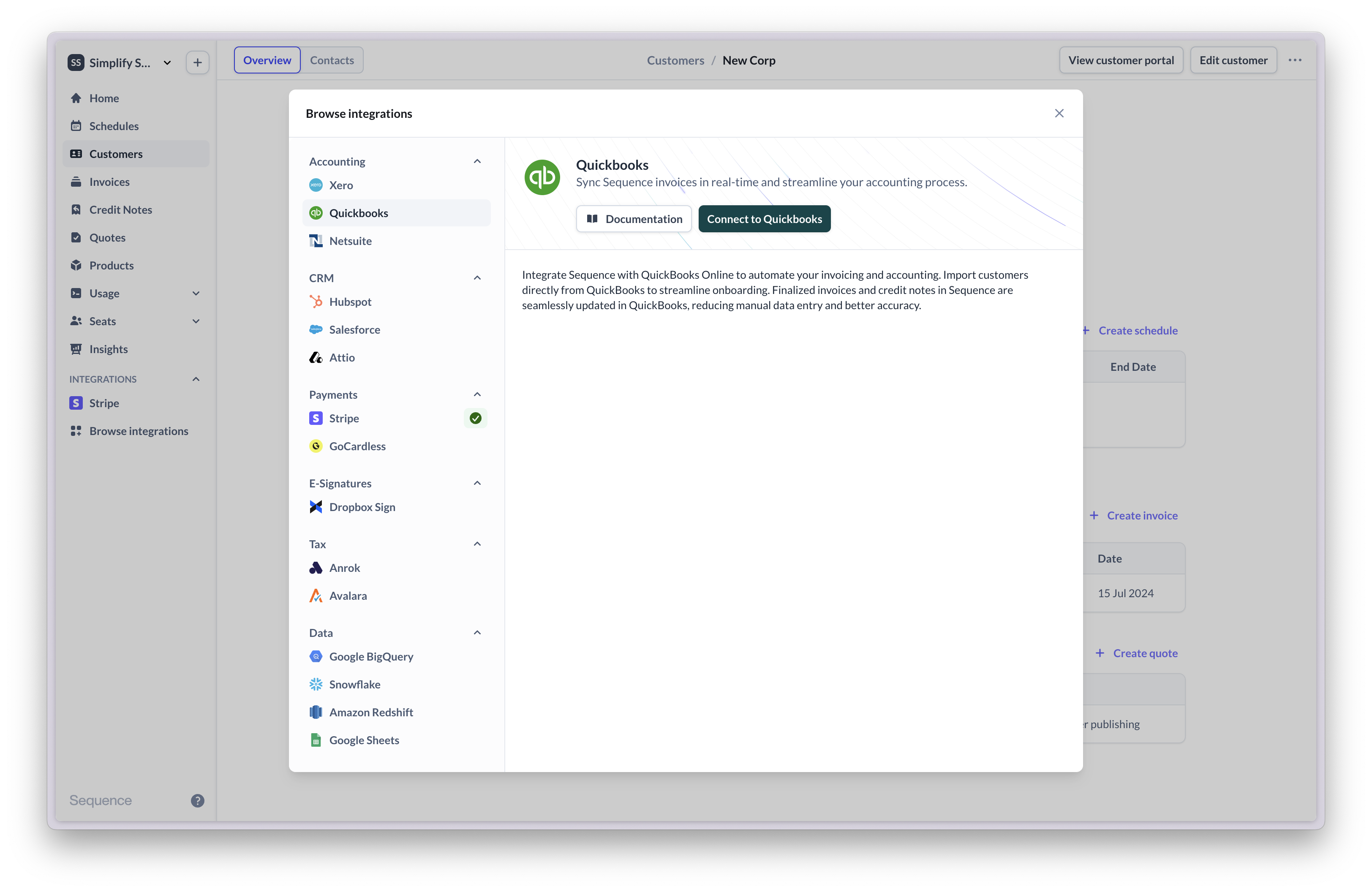

- Connect

- Configure integration

Go to integrations and connect to QuickBooks.

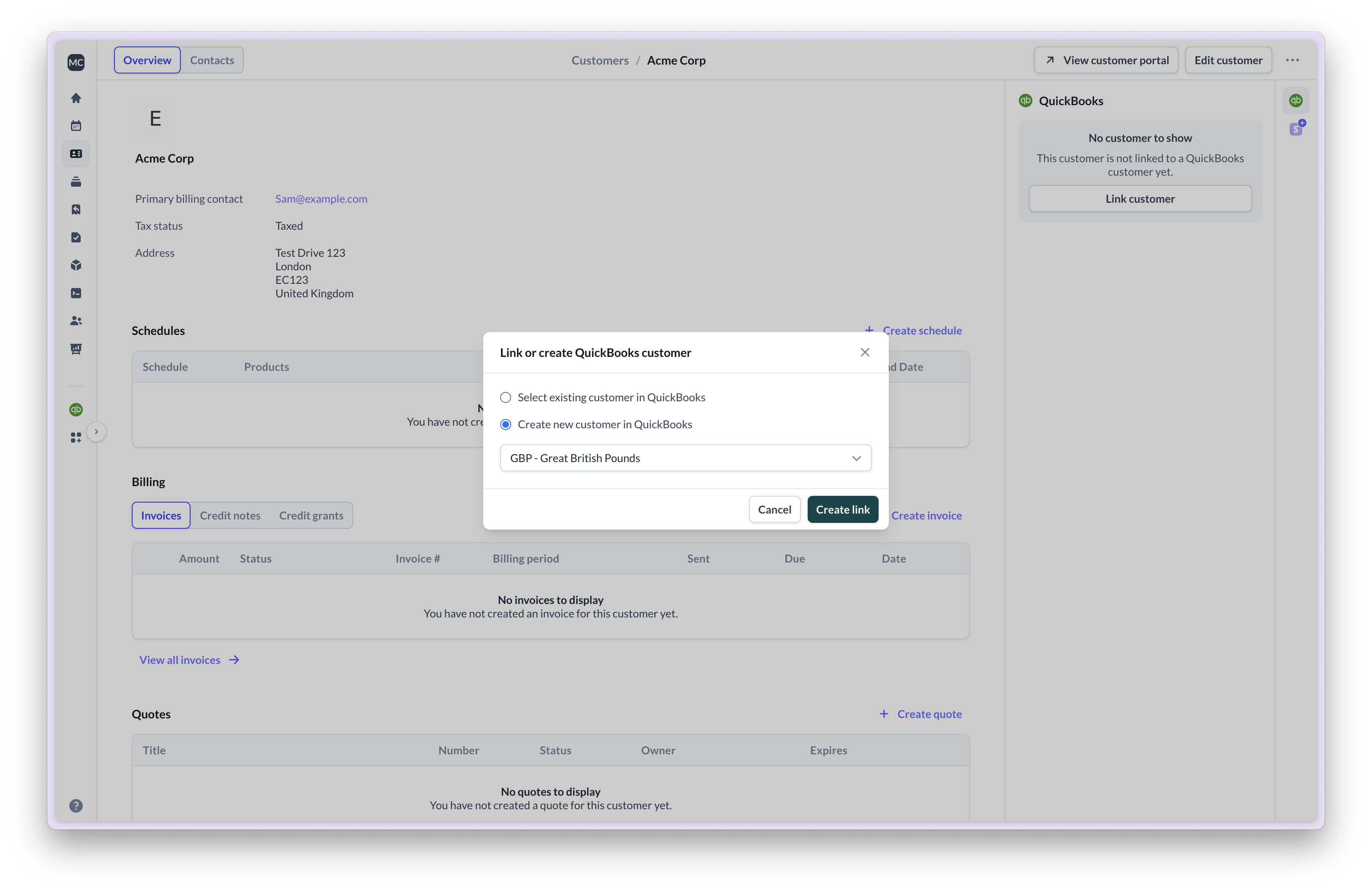

Linking customers to QuickBooks

To sync invoices to QuickBooks, your customers need to be linked. You can link Sequence customers to existing customers in QuickBooks or create a new customer in QuickBooks directly from Sequence. If multi-currency is enabled in your QuickBooks account, select a currency to assign to the customer.

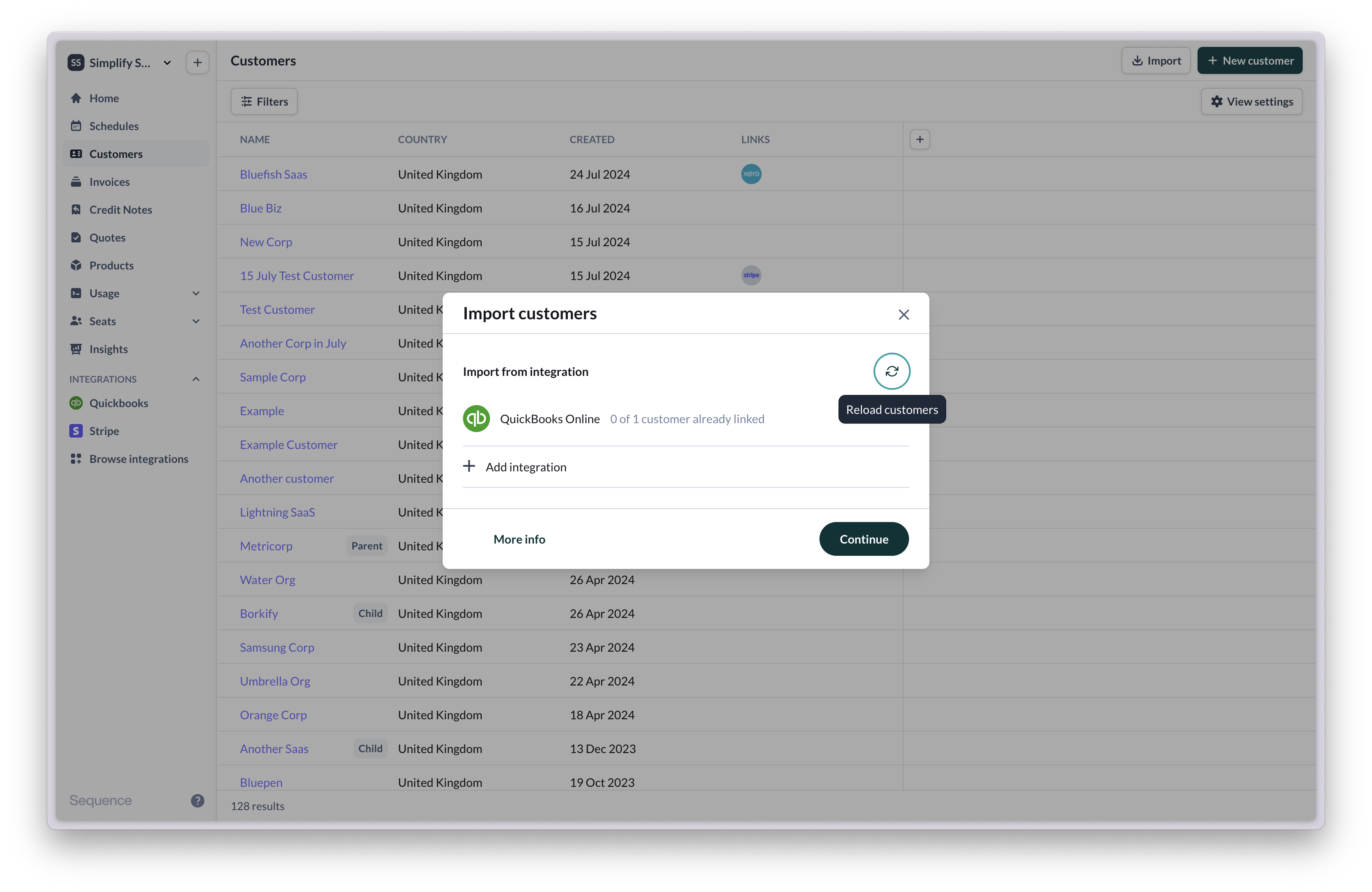

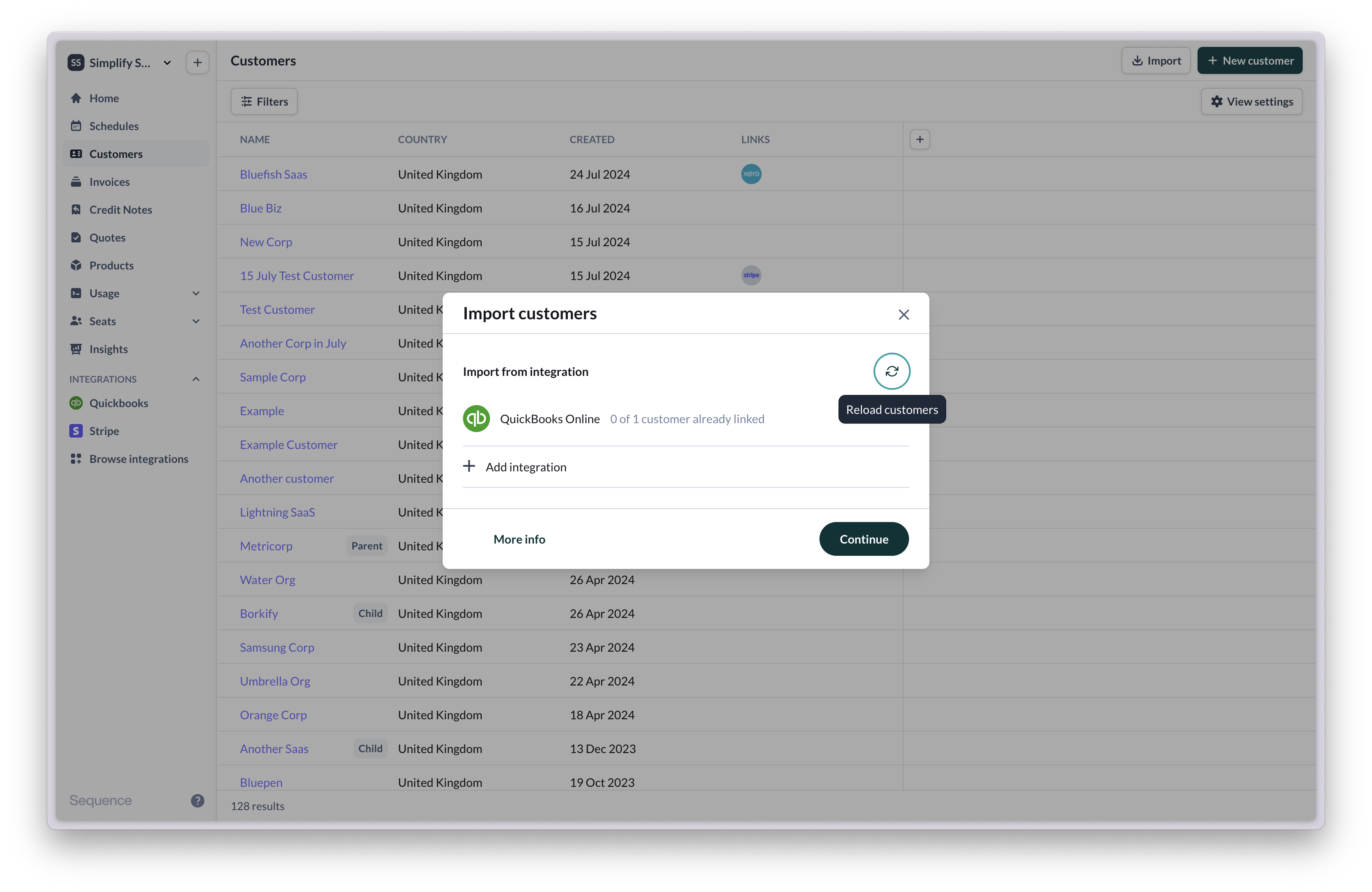

Importing customers from QuickBooks

Importing customers from QuickBooks

You can import customers from QuickBooks into Sequence to speed up your onboarding.

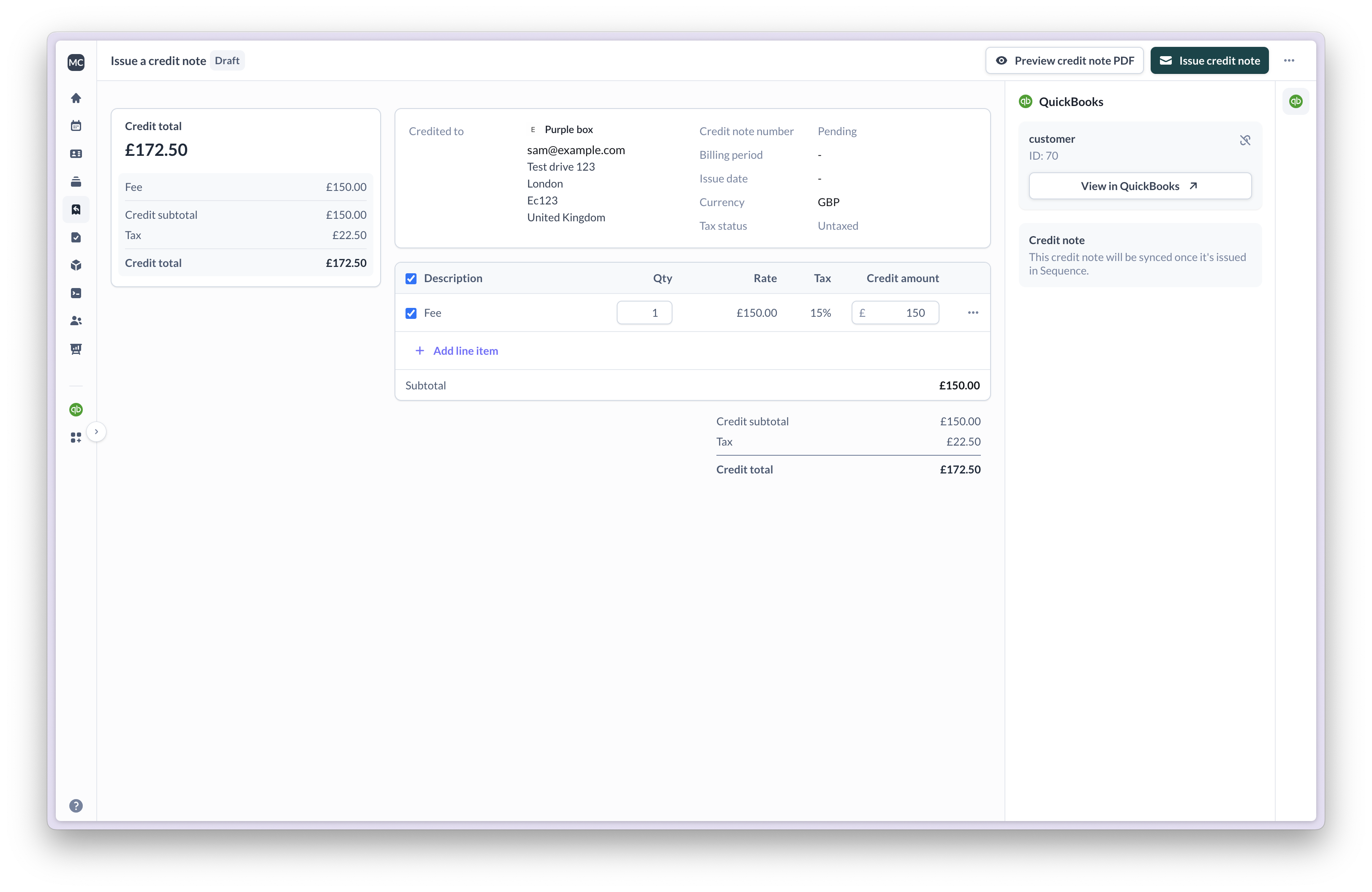

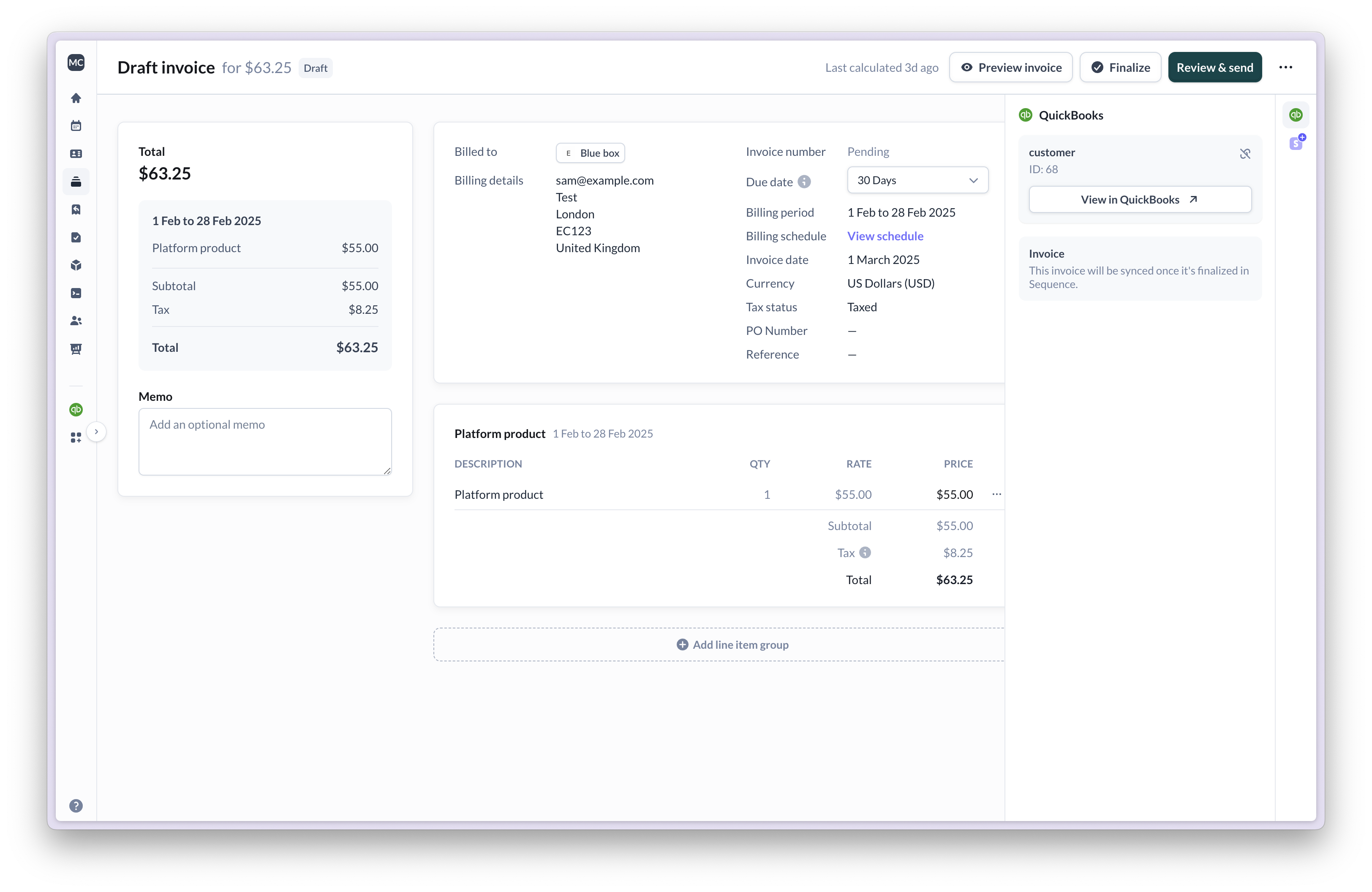

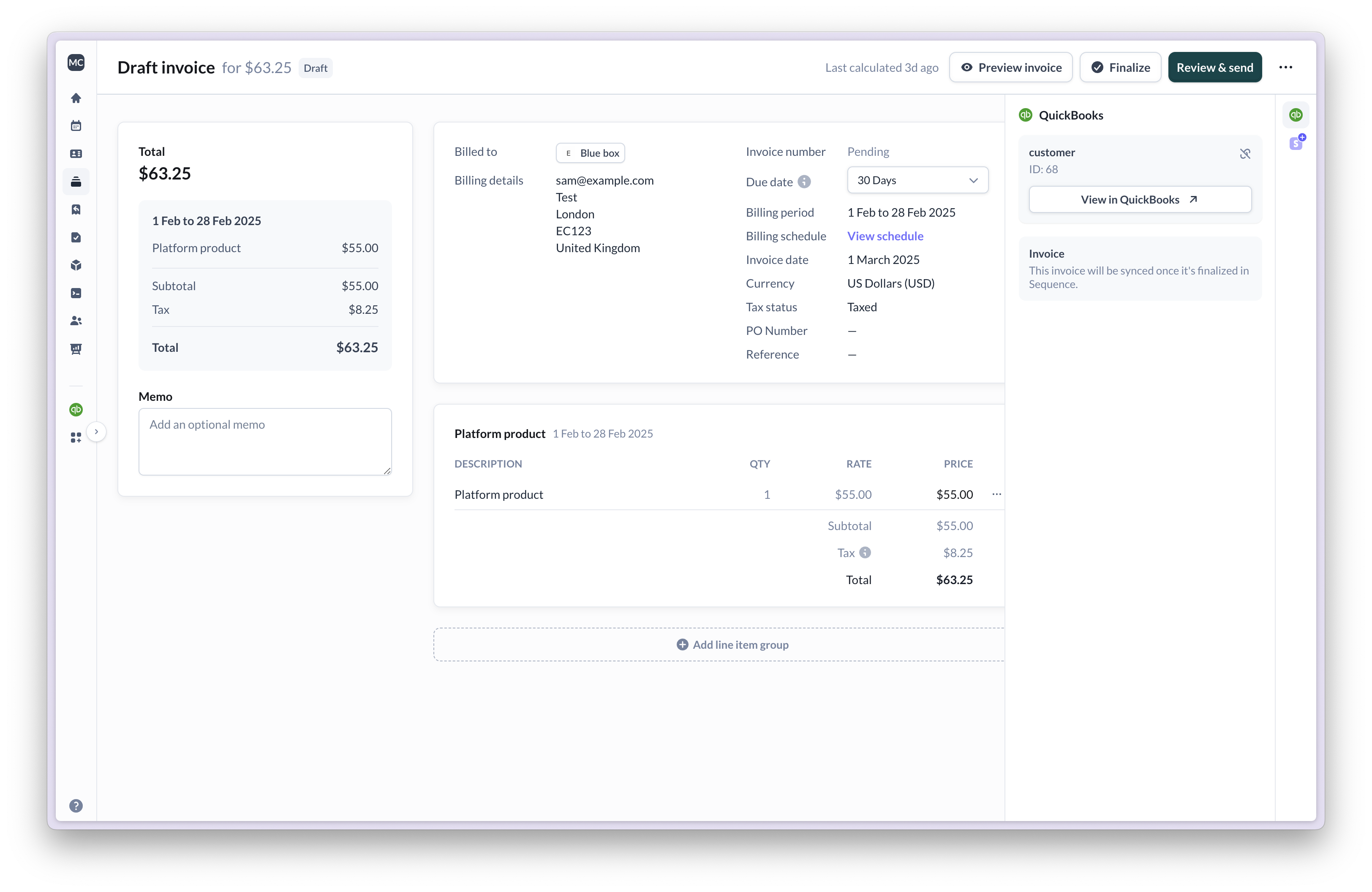

Syncing invoices & credit notes

When an invoice or credit note is finalized or sent, it is automatically synced to QuickBooks.- Sync an invoice

- Sync a credit note

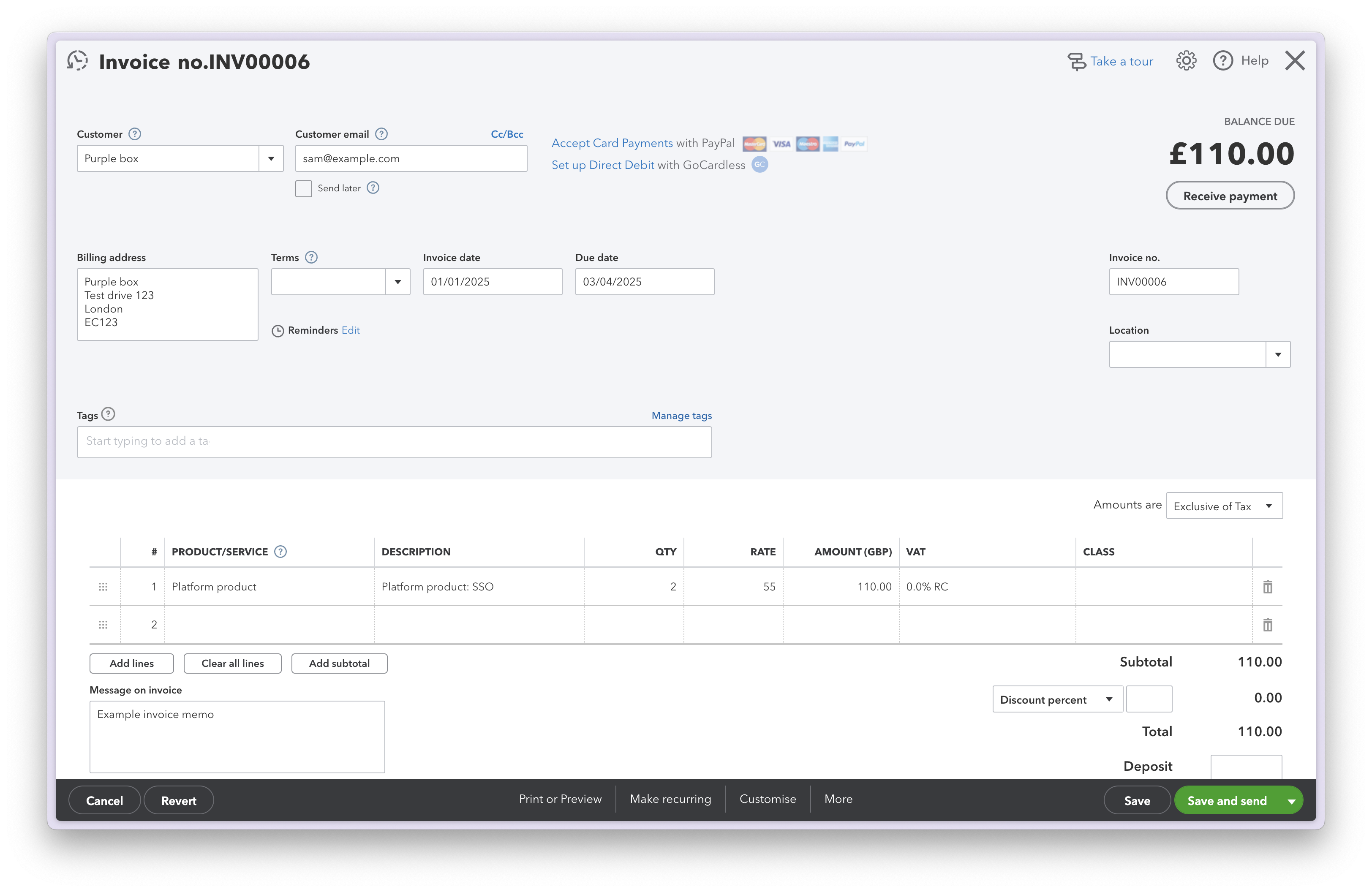

To sync an invoice with QuickBooks, finalize or send it.

Reconciling invoices

When an invoice is marked as paid in QuickBooks, Sequence will update the payment status and mark the invoice as paid. For invoices with a Stripe payment link, Sequence will sync the payment status from Stripe and ignore the payment status in QuickBooks. You need to reconcile your invoice in QuickBooks separately in this case. If a customer doesn’t use the Stripe payment link on your invoice, you need to manually mark the invoice as paid in Sequence.

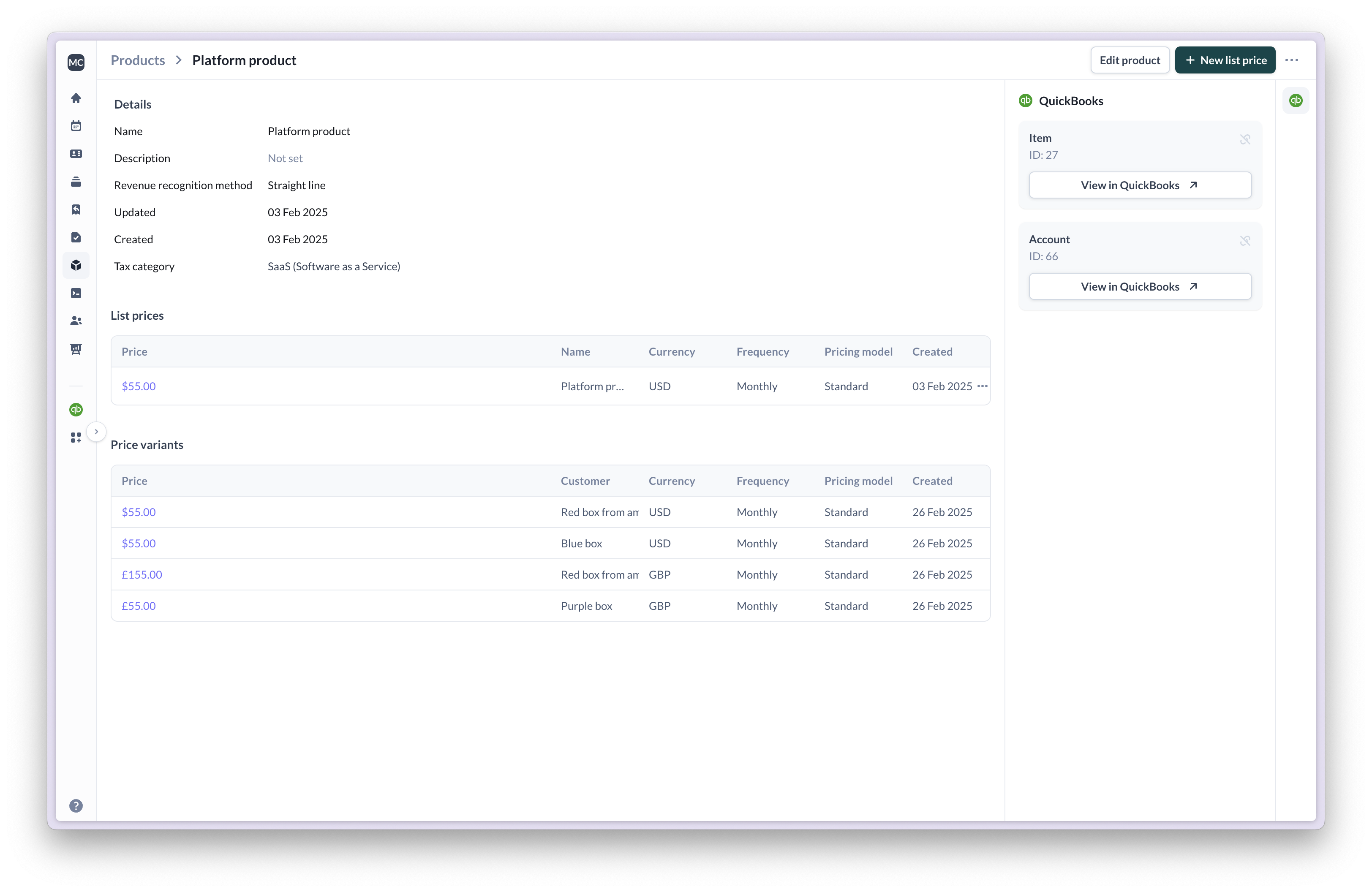

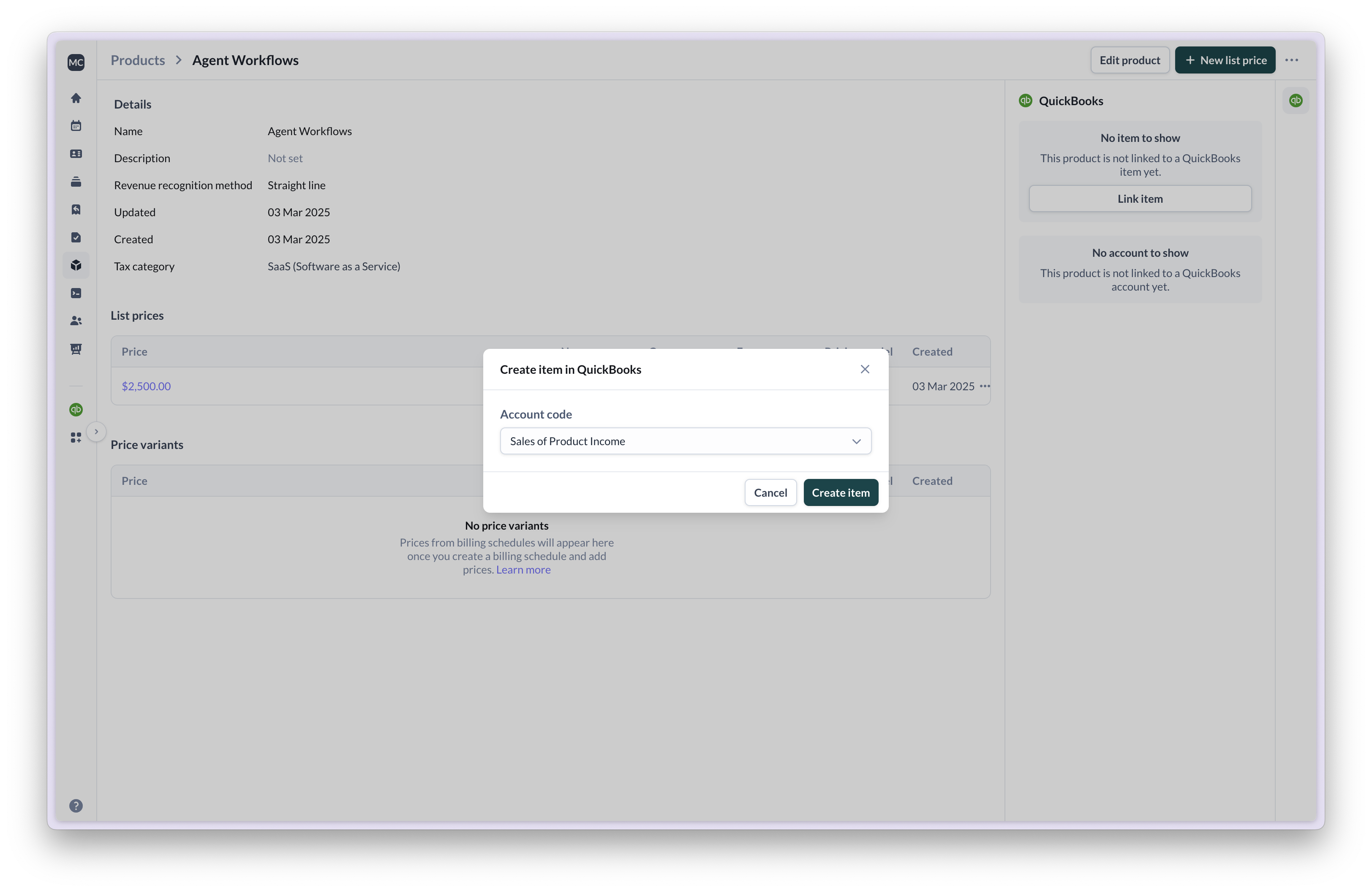

Linking products to QuickBooks items

To ensure invoice line items in QuickBooks are correctly categorized, map Sequence products to items and account codes. You can map products from the product catalog in Sequence. Linking a product will create a new item in QuickBooks, using the name of the product and the selected account code. This ensures synced invoice line items are accurately categorized.- Link product

- View item and account code

Item names in QuickBooks must be unique.

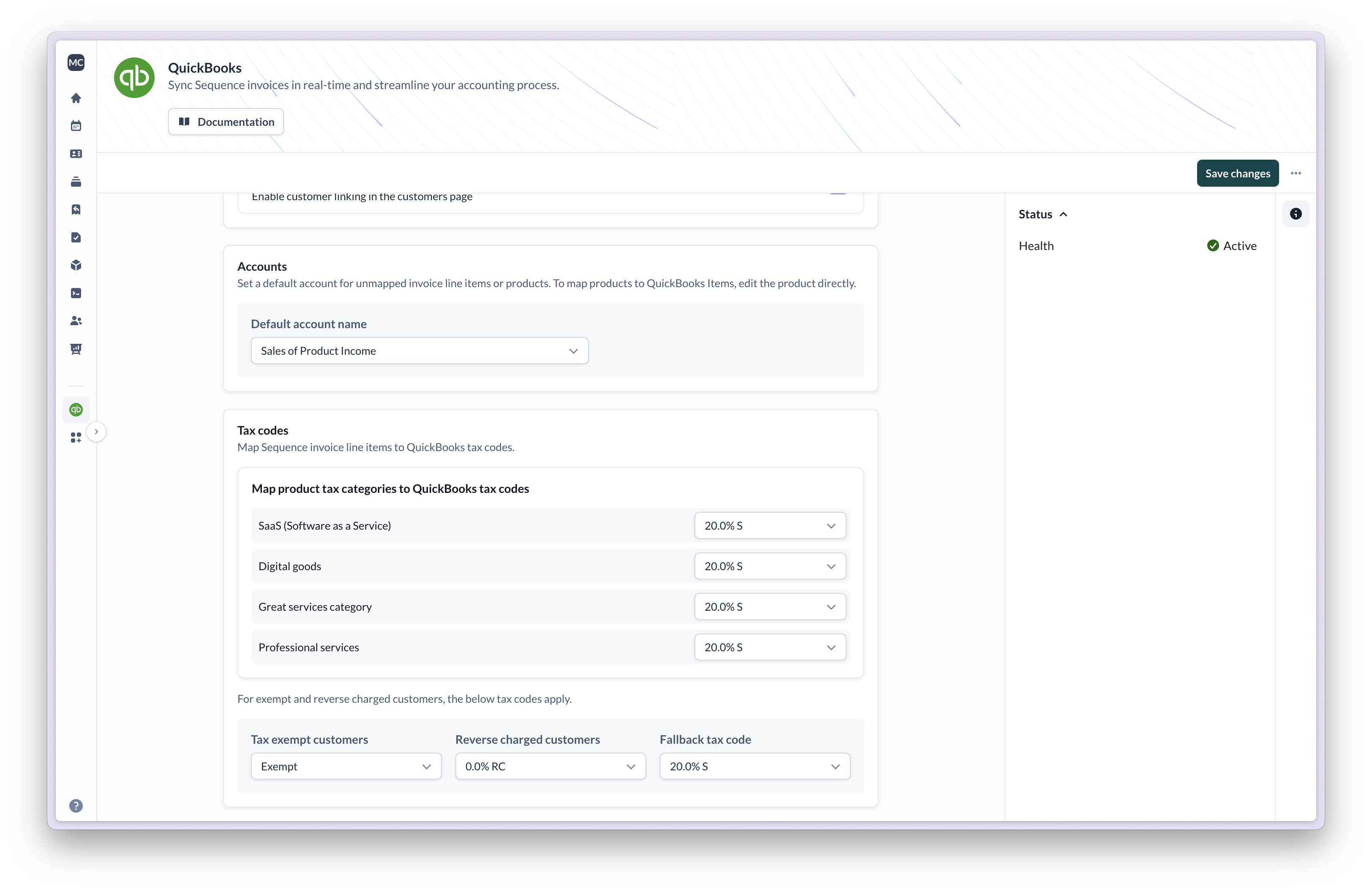

Account codes

In QuickBooks Online, line item amounts can be booked under different accounts via the item the line item they are mapped to. For example, for aPlatform product item with the account code Standard Product Sales, all line items for this item will be booked under the set account.

When you map a product from Sequence to a QuickBooks item, you can set the account code to assign to the item to ensure all line items are correctly categorized.

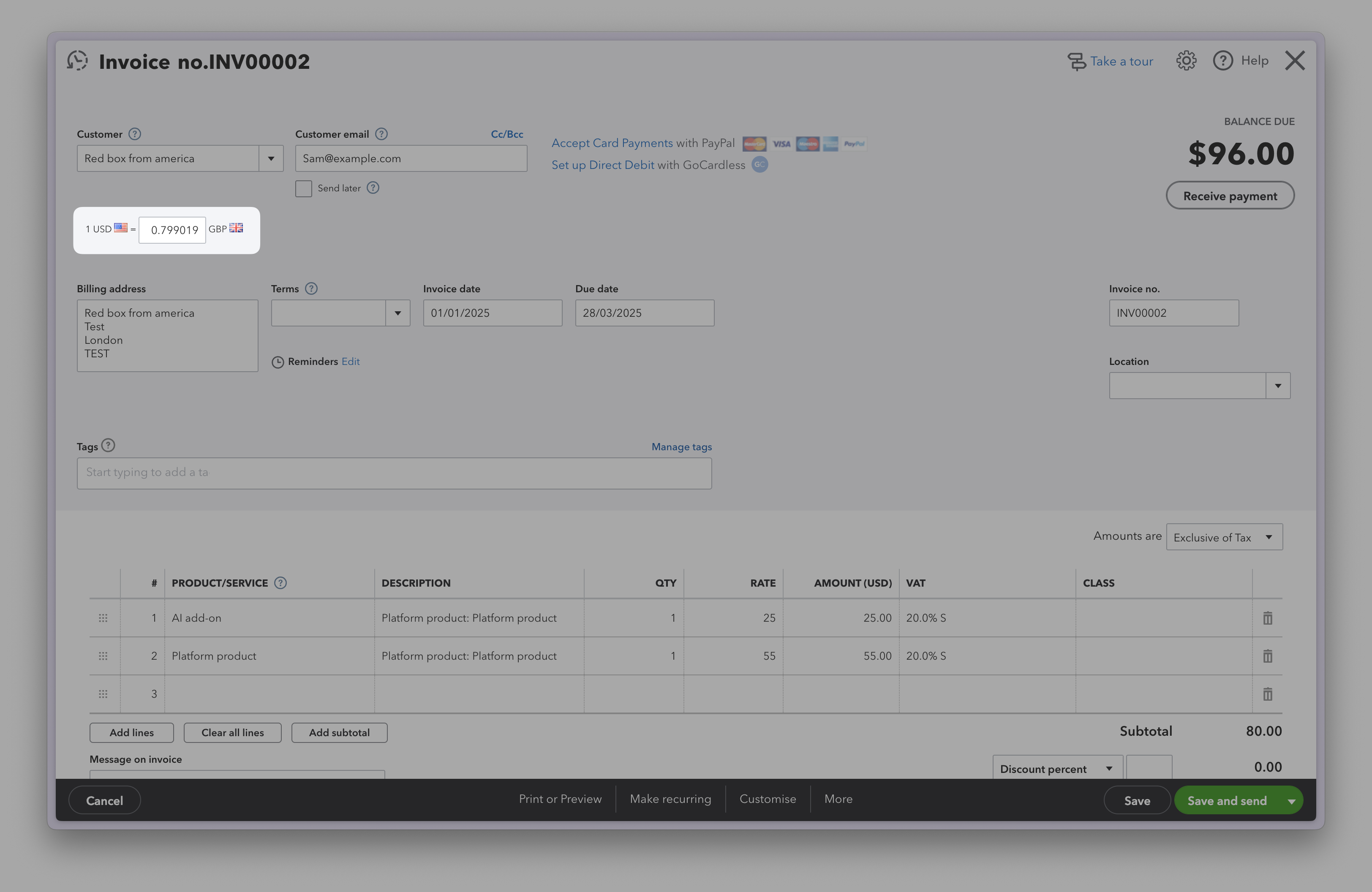

Currency conversion

If you are using multi-currency in your QuickBooks account, Sequence will automatically convert invoices into your home currency using the latest FX rate provided by QuickBooks. For example, if your home currency is GBP, invoices to EUR customers will include currency conversion for EUR:GBP.

Ensure that invoices or credit notes issued from Sequence match the QuickBooks customer’s currency to prevent sync errors.

Tax codes

When pushing an invoice or credit note to QuickBooks, Sequence will assign QuickBooks tax codes to invoice line items.- For taxed customers, the tax codes of the tax categories assigned to the invoice line items apply. The fall back tax code applies for unmapped line items or products.

- For tax exempt and reverse charged customers, the tax codes configured in integration settings apply.

- If none of the above are set, the default tax code of your QuickBooks account is applied. Failing that, the default tax code of customer in QuickBooks is applied.

- If customer is taxed,

TAXis applied as the tax code - If customer tax exempt or reverse charged,

NONis applied as the tax code

Invoice fields

| QuickBooks Online | Sequence |

|---|---|

| Customer | Linked customer |

| Customer email | Primary billing contact email |

| Billing address | Customer address |

| Invoice date | Invoice date (depending on accounting date preference) |

| Due date | Due date |

| Invoice number | Invoice number |

| Message on invoice | Memo |

| Line item: Product/Service | Sequence product (depending on item mapping) |

| Line item: Description | [Line item group name]: [Line item name] |

| Line item: VAT / Tax | QuickBooks tax code (depending on mapping) |

| Line item: Quantity | Line item qty |

| Line item: Rate | Line item rate |