What is revenue recognition

Revenue recognition is a set of accounting practices aimed at accurately reporting the revenue that a business is generating over time. Generally accepted accounting principles (GAAP) and accounting standards such as ASC 606 and IFRS 15 hinge on the idea that revenue must be recognized at the time it is earned, that is when a contracted service is delivered to the customer, as opposed to when an invoice is issued or cash is received. These guidelines are a legal requirement for public companies and other entities above certain sizes, but apply broadly for any business who enters into contract with their customers, and are critical to forming a reliable picture of a company’s financial health and trajectory.Key concepts

Billing vs. recognition timing Revenue recognition distinguishes between when customers are billed and when revenue is actually earned:- In-advance billing: Customers are charged upfront but revenue is recognized over time as services are delivered (e.g., annual subscriptions paid upfront)

- In-arrears billing: Services are delivered first and billed afterwards, with revenue recognized as services are delivered (e.g., monthly usage-based billing)

- Straight-line: Revenue divided evenly across the service period (most common)

- Usage-based: Revenue recognized based on actual usage each period

- Point-in-time: Full amount recognized on a specific date (e.g., implementation fees)

- Milestone: Revenue recognized only when milestones are marked as complete

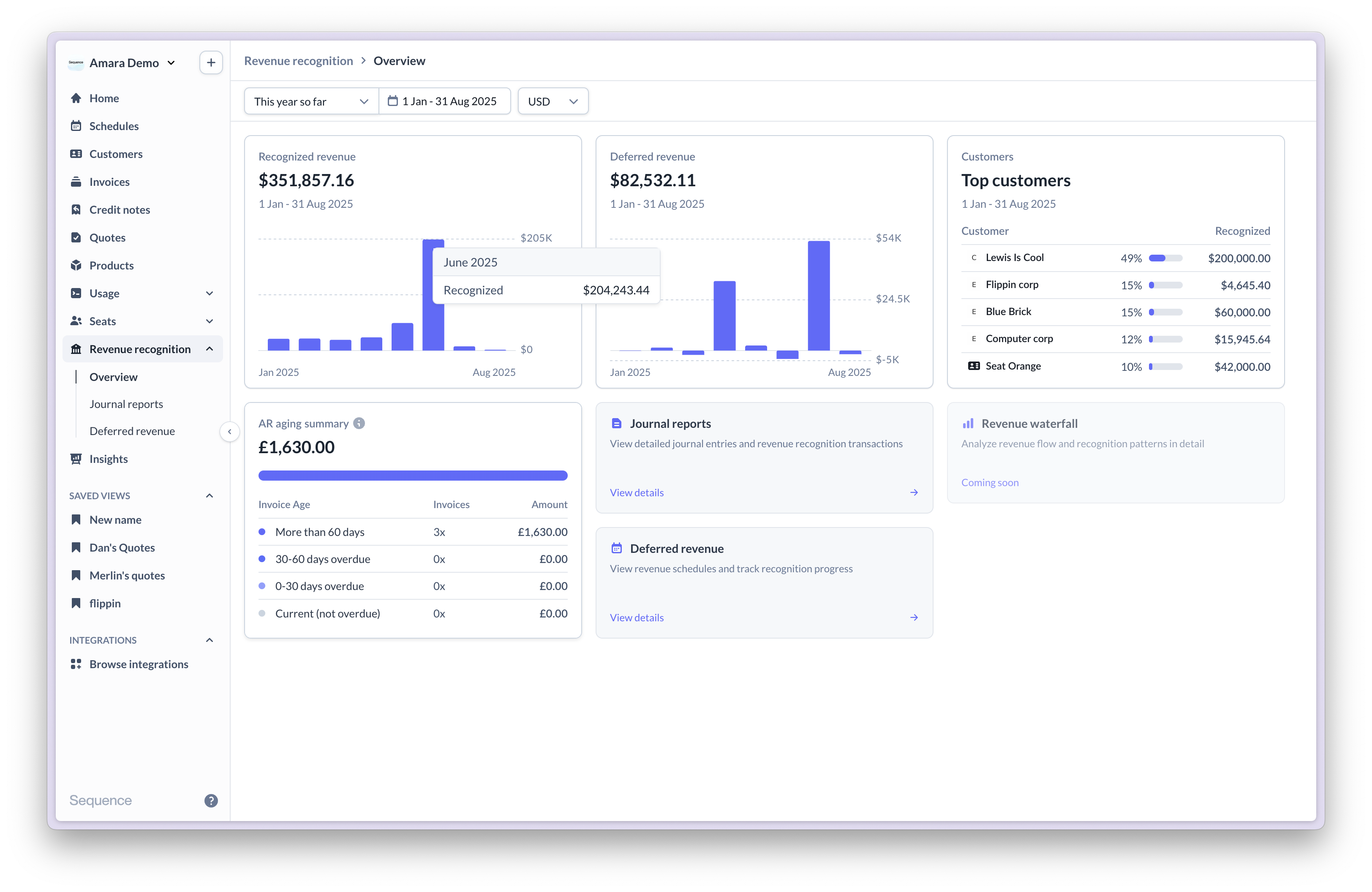

- Billed Revenue: Amounts invoiced to customers

- Recognized Revenue: Revenue earned through service delivery

- Deferred Revenue: Invoiced amounts not yet earned (for advance billing)

- Unbilled Revenue: Earned revenue not yet invoiced (for arrears billing)

Frequently asked questions

When should I use revenue recognition?

When should I use revenue recognition?

Revenue recognition is essential for businesses with subscription models, usage-based pricing, or any scenario where billing timing doesn’t match service delivery. It’s required for public companies under ASC 606/IFRS 15 but beneficial for any business wanting accurate financial reporting.

What's the difference between billing and recognition?

What's the difference between billing and recognition?

Billing is when you invoice customers. Recognition is when you’ve actually earned the revenue by delivering services. For example, an annual subscription paid upfront is billed immediately but recognized monthly as you provide the service.

Which recognition method should I use?

Which recognition method should I use?

- Straight-line: Most subscriptions and fixed services

- Usage-based: API usage, data processing, consumption billing

- Point-in-time: Setup fees, implementation services

- Milestone: Project work with specific deliverables

Can I handle complex scenarios like discounts and credits?

Can I handle complex scenarios like discounts and credits?

Yes. Sequence automatically handles product-level and invoice-level discounts according to ASC 606 guidelines. Credit notes reverse revenue from current balances (deferred first, then recognized). See the use cases guide for details.

How are product-level discounts handled in journals?

How are product-level discounts handled in journals?

Product-level discounts are rolled up into the same journal entry as the product. Sequence creates a single journal for the net amount after applying the product discount. For example, a 120 discount generates one journal entry for $1,080.

How are global discounts allocated across invoice line items?

How are global discounts allocated across invoice line items?

Global (invoice-level) discounts are proportionally allocated across all line items on the invoice based on their standalone selling price. Sequence creates separate journal entries for each line item’s net amount after the discount allocation. This ensures proper revenue allocation while maintaining ASC 606 compliance.

How often should I export journal reports?

How often should I export journal reports?

Most businesses export monthly for their month-end close process. You can export daily details or monthly summaries depending on your accounting system’s requirements.