Credits are only consumed by invoices created by billing schedules (not one time invoices). For a customer to consume credits, they need to have a .

- Cash, or CURRENCY, which can act as a generic pre-payment for a customer

- Unit, or METRIC, which provides entitlement to use a specified number of units for a given metric (e.g. 10,000 API Calls)

- Guaranteed prepayment

- Incentives to try or subscribe to a new product

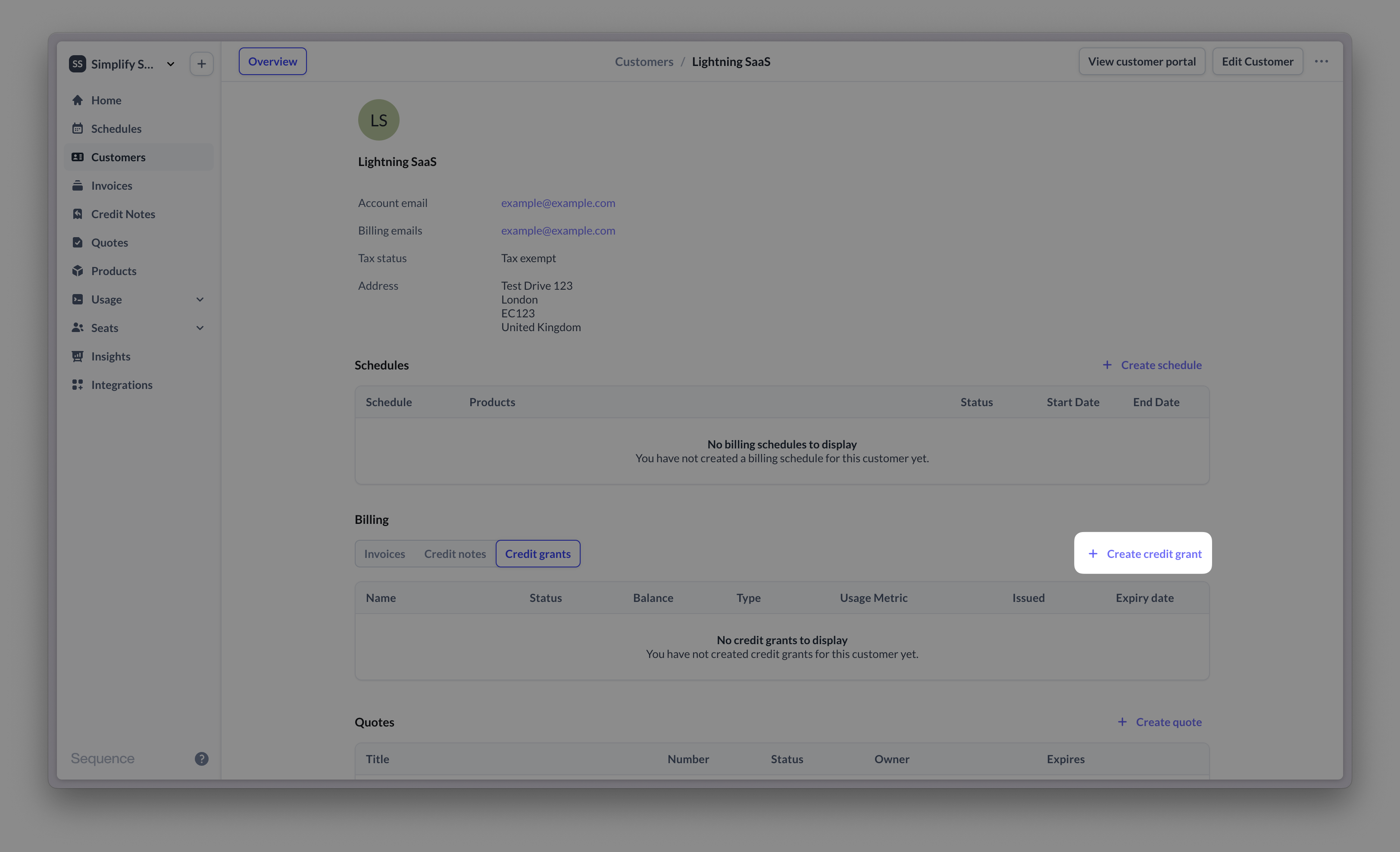

Getting started with credits

To begin using credit grants in Sequence, transfer your customers’ existing credit balances. Create a credit grant for each customer’s current balance. Sequence will make draft invoices for new credit grants, but since it’s a balance transfer, you can void the invoice. Example: Helios is a company that offers OCR tech to turn PDFs into structured data. They charge customers based on API calls. Some customers, like Acme Corp, bought prepaid API credits. Helios bills customers at the end of each month and starts using Sequence for usage-based billing in March 2023.- Acme bought 5000 API credits in January 2023.

- By the end of February, Acme has 1732 API credits left.

- To move the credit balance to Sequence, Helios’ billing operator creates a credit grant for Acme for 1732 credits and voids the related invoice.

- At the end of March, Sequence will automatically use this balance.