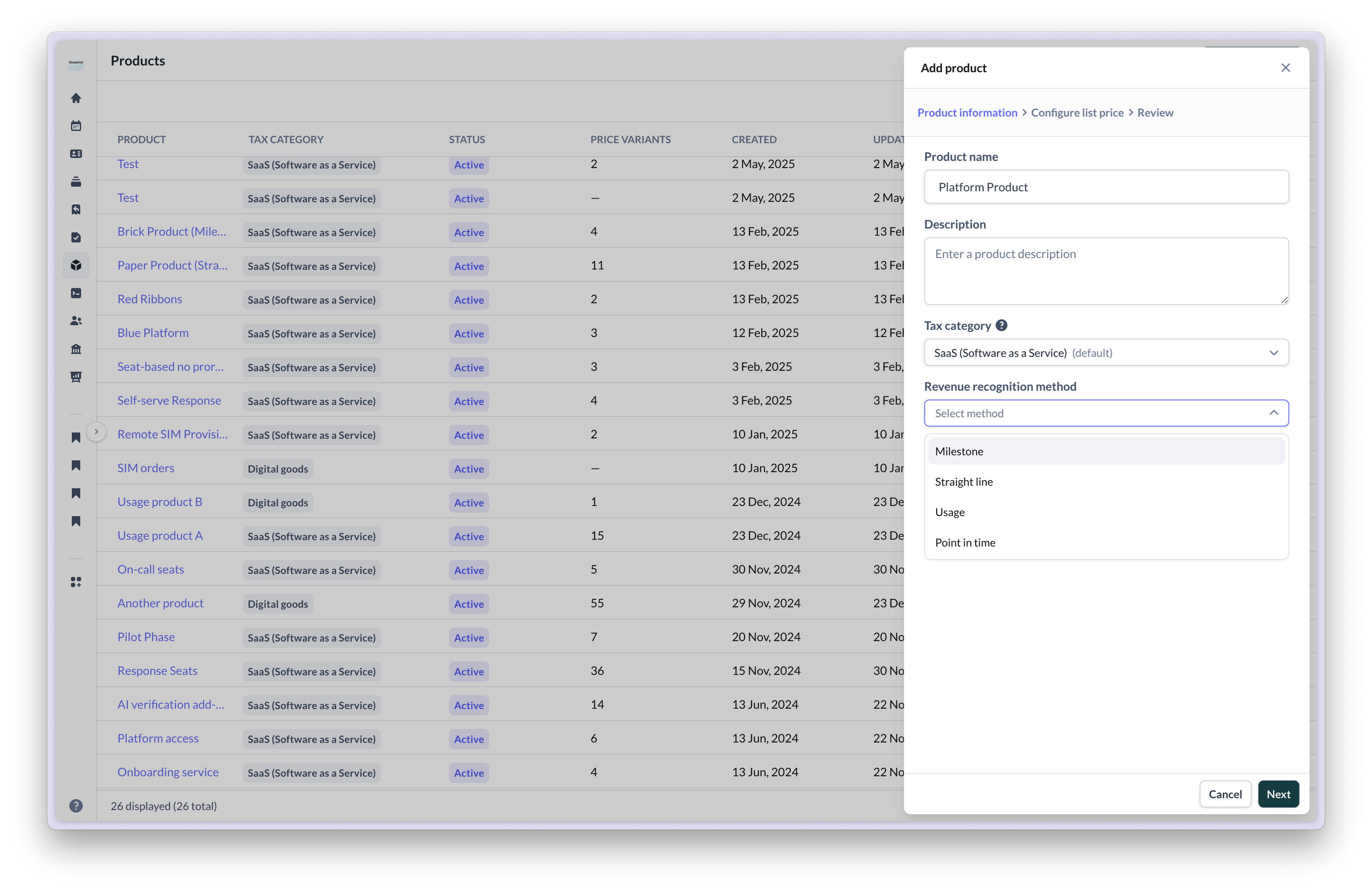

Recognition methods can be set per product in your product catalog and overwritten on individual invoice line items.

Straight-line recognition

When to use: For services delivered consistently over time, such as subscriptions, licenses, or ongoing support. We use the straight-line methodology with partial period proration, to evenly allocate revenue across the service period. Amounts for partial months are prorated based on actual days (Sequence uses Act/365). Amounts for full months are allocated evenly (30/360). These even (or prorated) monthly amounts are then further broken down into a daily granularity, based on the number of days in that month. Any remainder pennies are added to the last day of a given month and the last month of a given period. Worked examplesMonthly arrears billing with proration

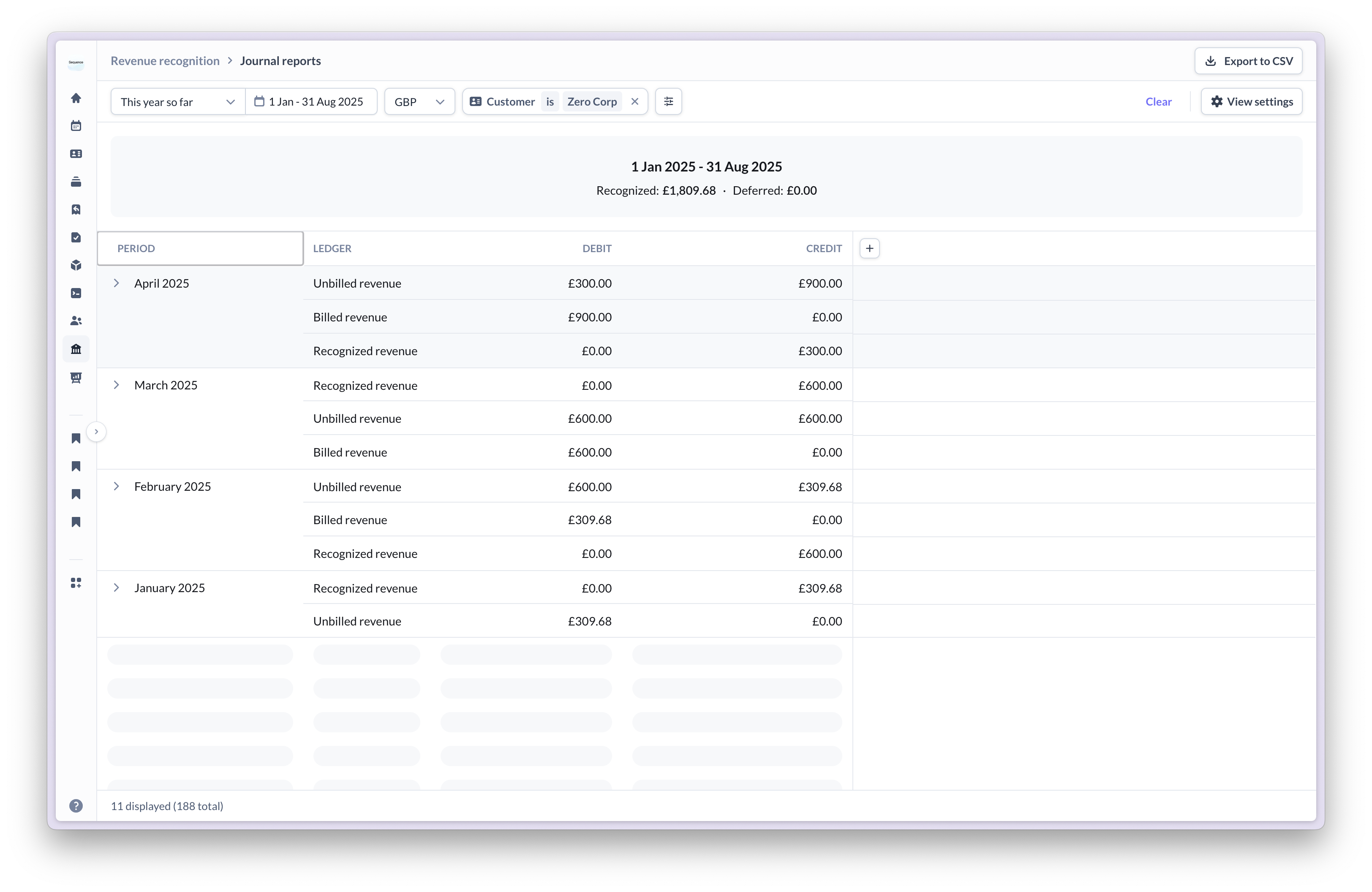

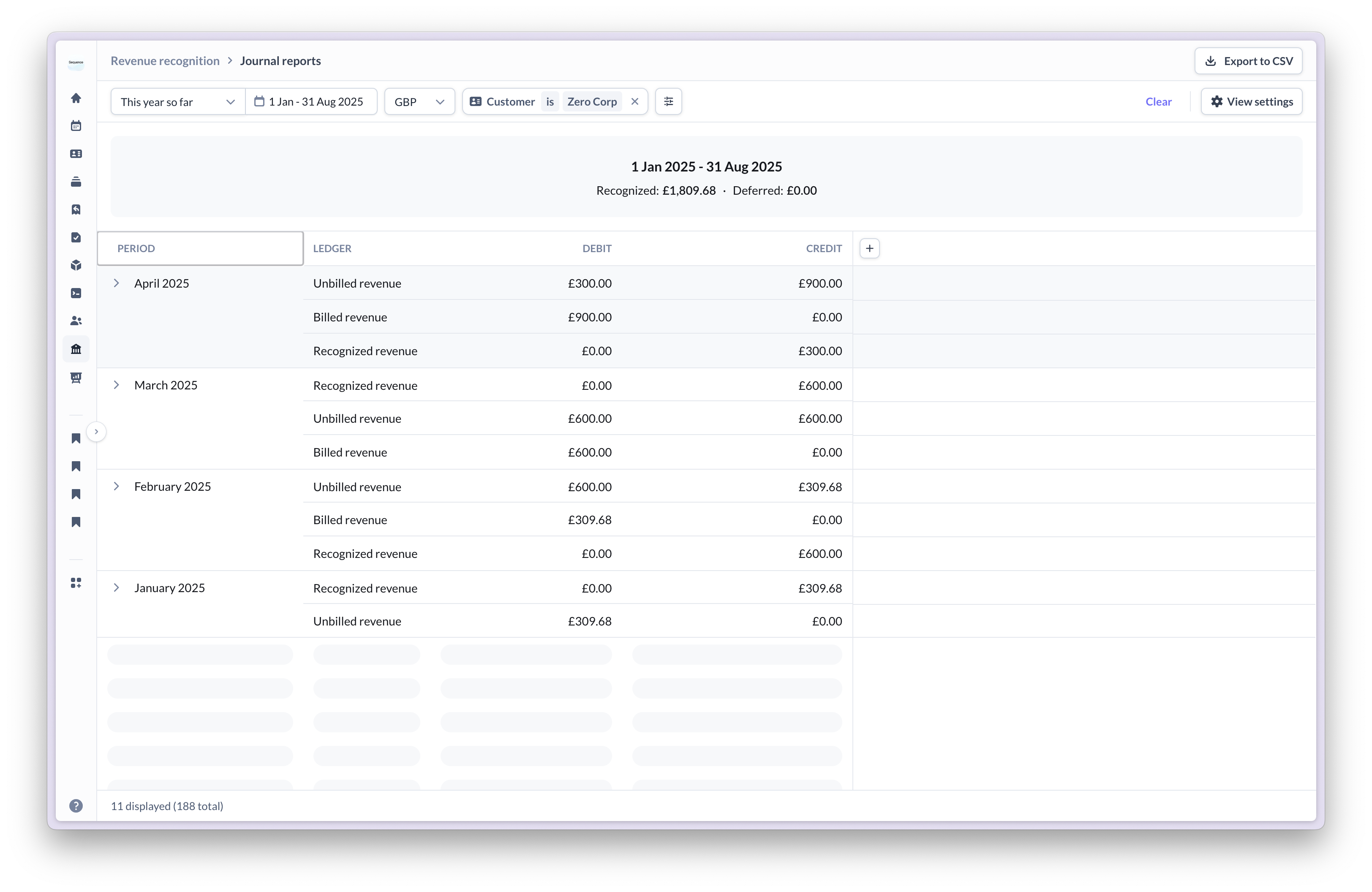

Monthly arrears billing with proration

Scenario

- Amount: £600.00 per month

- Billing: Monthly in arrears

- Service period: January 16 - April 15, 2025 (90 days total)

-

Monthly recognition totals:

- January (16 days): £309.68 recognized, invoiced February 1st

- February (28 days): £600.00 recognized, invoiced March 1st

- March (31 days): £600.00 recognized, invoiced April 1st

- April (15 days): £300.00 recognized, invoiced April 16th

-

Daily recognition granularity: Revenue recognized evenly as services are delivered

- Daily amount: £600.00 monthly amount ÷ days in that month

- Daily journal: Debit Unbilled Revenue (+daily amount), Credit Recognized Revenue (+daily amount)

-

On each invoice date: Unbilled revenue becomes billed

- Monthly journal: Debit Billed Revenue (+monthly amount), Credit Unbilled Revenue (-monthly amount)

First and last months are prorated based on actual days in the service period, ensuring accurate revenue recognition for partial periods.

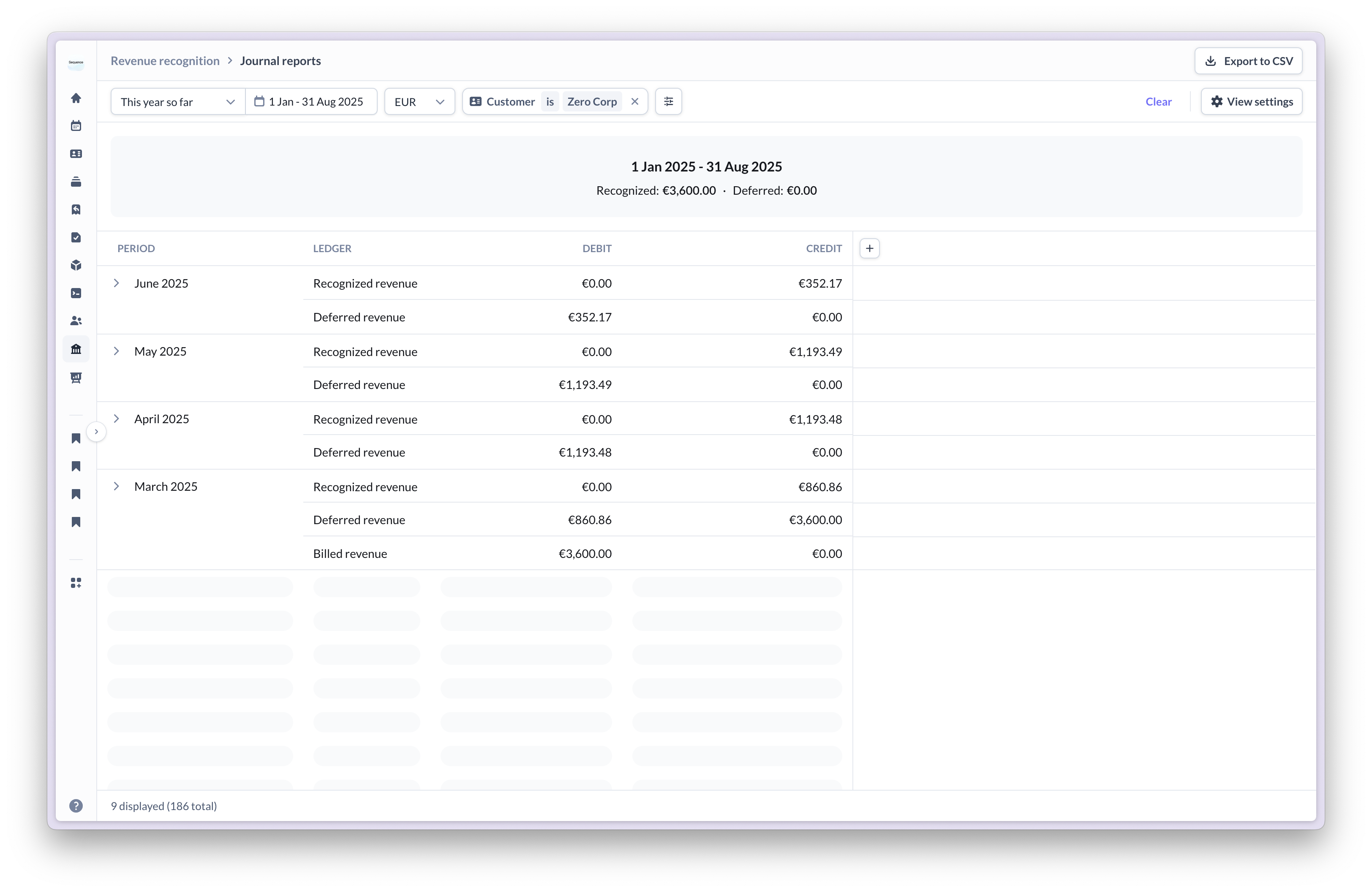

Quarterly in-advance billing

Quarterly in-advance billing

Scenario

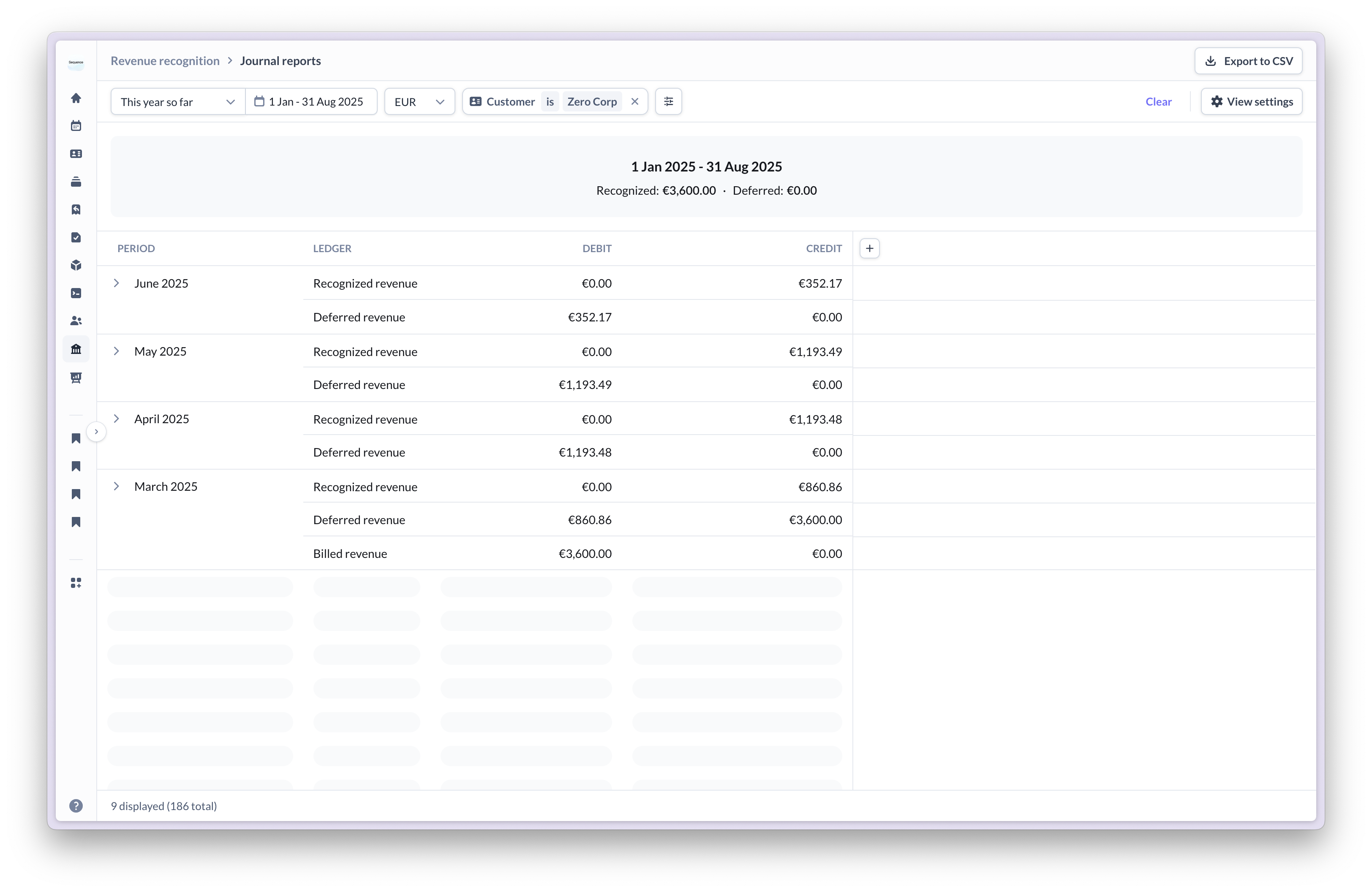

- Amount: €3,600.00 per quarter

- Billing: Quarterly in advance

- Service period: March 10 - June 9, 2025 (92 days total)

-

On invoice date: Full amount deferred

- Debit: Billed Revenue (+€3,600)

- Credit: Deferred Revenue (+€3,600)

-

Monthly recognition totals:

- March (22 days): €860.86 recognized (€3,600 ÷ 92 days * 22 days)

- April (30 days): €1,193.48 recognized (allocated evenly between full months)

- May (31 days): €1,193.49 recognized (allocated evenly between full months, with remainder)

- June (9 days): €352.17 recognized (€3,600 ÷ 92 days * 9 days)

-

Daily recognition granularity: Revenue recognized evenly as services are delivered

- Daily amount: e.g. March €39.13 per day (€860.86 ÷ 22 days)

- Daily journal: Debit Deferred Revenue (-€39.13), Credit Recognized Revenue (+€39.13)

For advance billing, revenue is initially deferred and then recognized daily as services are delivered over the contract period.

In-advance billing with straight-line recognition

For subscriptions paid upfront:-

On invoice date: Revenue is deferred

- Debit: Billed Revenue (+$12,000)

- Credit: Deferred Revenue (+$12,000)

-

Daily recognition: Revenue is recognized over time

- Debit: Deferred Revenue (-$33/day)

- Credit: Recognized Revenue (+$33/day)

In-arrears billing with straight-line recognition

For services billed after delivery:-

During service period: Revenue is recognized as unbilled

- Debit: Unbilled Revenue (+monthly amount)

- Credit: Recognized Revenue (+monthly amount)

-

On invoice date: Unbilled revenue becomes billed

- Debit: Billed Revenue (+monthly amount)

- Credit: Unbilled Revenue (-monthly amount)

Usage-based recognition

When to use: For services where value delivery varies based on customer usage, such as API calls, data processing, or consumption-based pricing. Revenue is recognized at the end of the period based on the actual usage during period, regardless of when the invoice is issued.In-arrears usage-based billing

Most usage-based pricing follows this pattern:-

As usage occurs: Revenue is recognized in full at the end of the period

- Debit: Unbilled Revenue (+usage amount)

- Credit: Recognized Revenue (+usage amount)

-

On invoice date: Unbilled revenue becomes billed

- Debit: Billed Revenue (+usage amount)

- Credit: Unbilled Revenue (-usage amount)

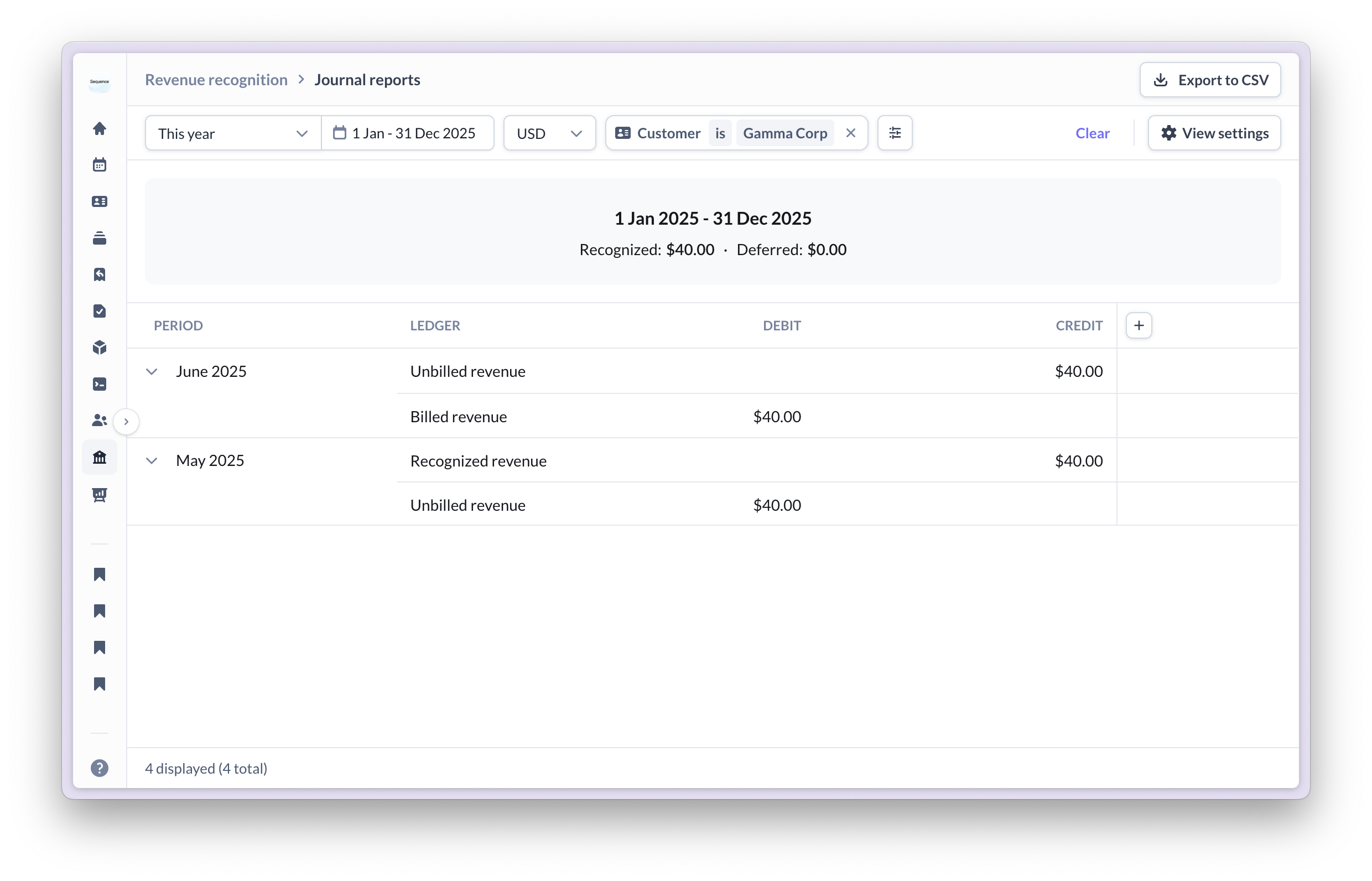

Worked example: Monthly usage-based billing in arrears

Worked example: Monthly usage-based billing in arrears

Scenario

- Product: Usage Product at $10.00 per unit

- Billing: Monthly in arrears

- Service period: May 1 - May 31, 2025

- Usage: 4 events during May

-

During service period: Usage events tracked but not yet recognized

- 4 events × $10.00 = $40.00 total usage for May

-

End of service period (May 31st): All usage recognized in single journal

- Journal: Debit Unbilled Revenue (+$40.00), Credit Recognized Revenue (+$40.00)

-

On invoice date (June 1st): Unbilled revenue becomes billed

- Invoice amount: $40.00 for May usage

- Journal: Debit Billed Revenue (+$40.00), Credit Unbilled Revenue (-$40.00)

Usage-based recognition captures revenue as value is delivered through actual consumption, regardless of billing timing.

Point-in-time recognition

When to use: For services delivered at a specific moment, such as implementation fees, setup charges, or one-time deliverables. The entire amount is recognized immediately on a specific date (typically the service delivery date).Point in time recognition is only available as a recognition method when the service period of the item is a single day.

- Full $5,000 recognized on delivery date

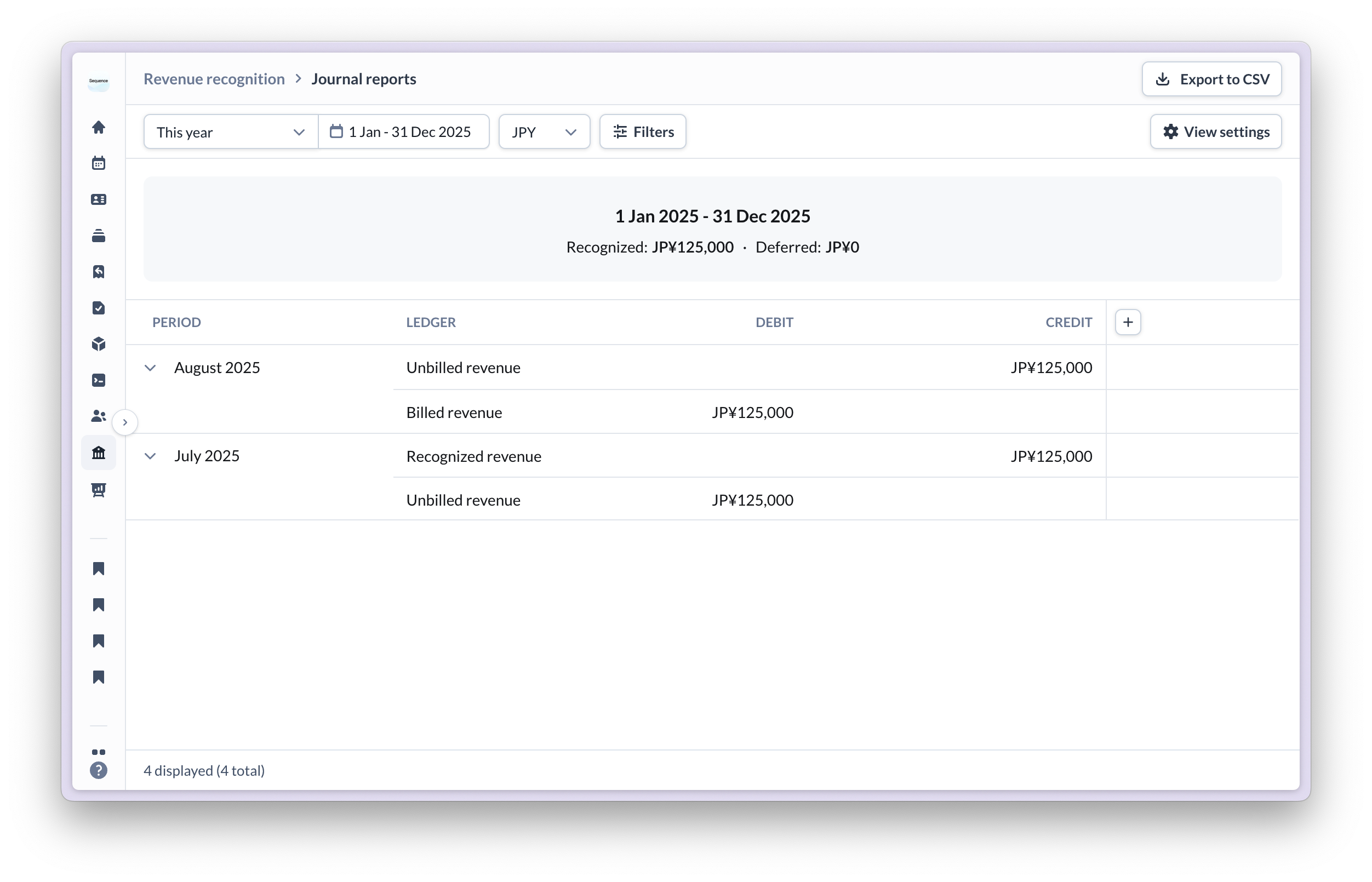

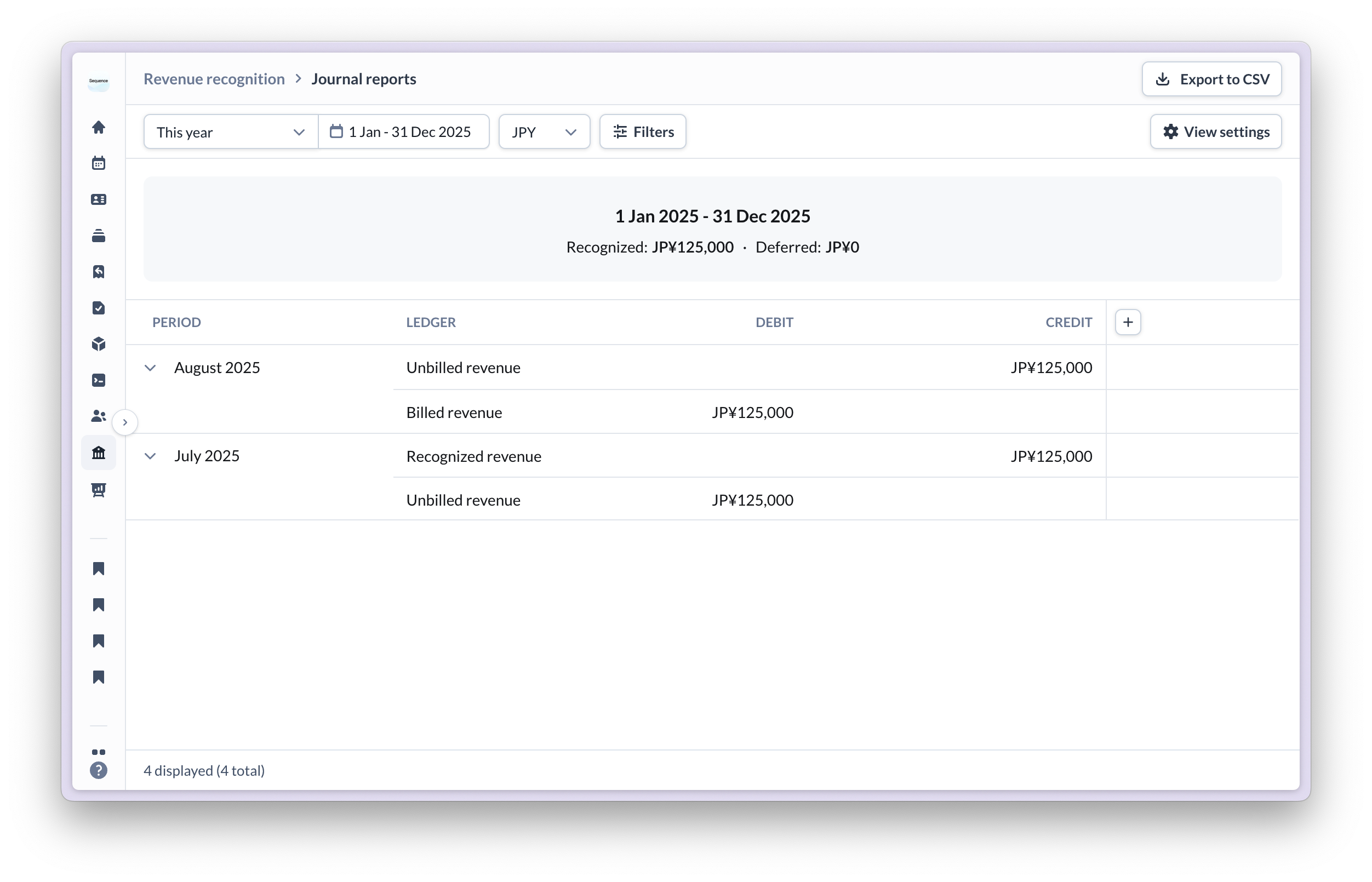

Worked example: In-arrears point-in-time billing

Worked example: In-arrears point-in-time billing

Scenario

- Amount: ¥125,000

- Service period: July 10, 2025 (single day)

- Invoice date: August 7, 2025

- Recognition method: Point-in-time

-

On service delivery date (July 10th): Full amount recognized as unbilled

- Journal: Debit Unbilled Revenue (+¥125,000), Credit Recognized Revenue (+¥125,000)

-

On invoice date (August 7th): Unbilled revenue becomes billed

- Journal: Debit Billed Revenue (+¥125,000), Credit Unbilled Revenue (-¥125,000)

Point-in-time recognition captures the full revenue immediately when the service is delivered, regardless of the date the invoice is issued.

In-advance point-in-time

For fees paid before delivery: On invoice date: Revenue is recognized immediately- Debit: Billed Revenue (+$5,000)

- Credit: Recognized Revenue (+$5,000)

Point-in-time recognition creates a single journal entry on the invoice accounting date, regardless of billing timing. Revenue is recognized immediately rather than deferred.

In-arrears point-in-time

For fees billed after delivery:-

On delivery date: Revenue is recognized as unbilled

- Debit: Unbilled Revenue (+$5,000)

- Credit: Recognized Revenue (+$5,000)

-

On invoice date: Unbilled revenue becomes billed

- Debit: Billed Revenue (+$5,000)

- Credit: Unbilled Revenue (-$5,000)

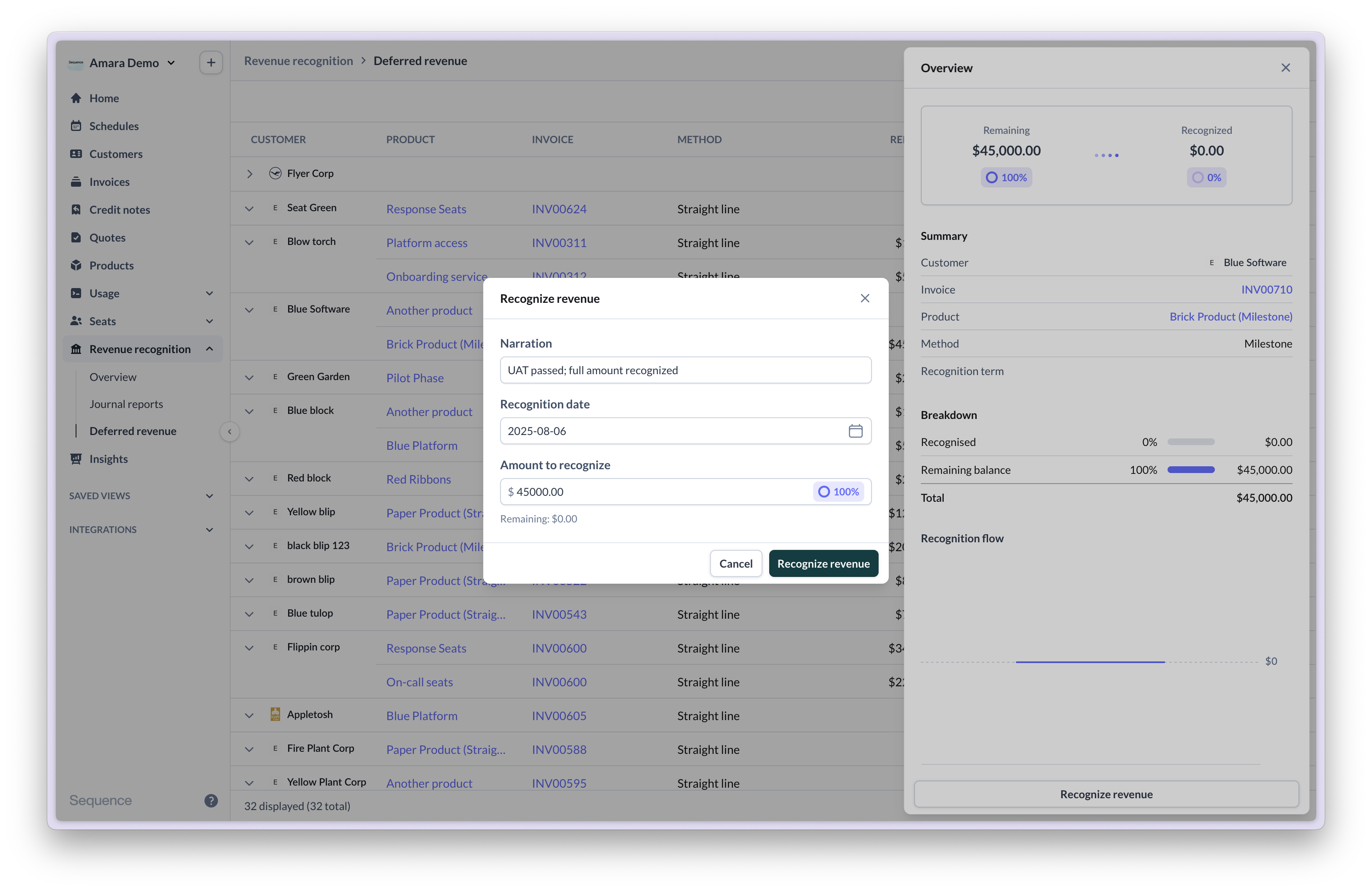

Milestone-based recognition

When to use: For project-based work with specific deliverables, such as consulting engagements, custom development, or phased implementations. Revenue is only recognized when milestones are manually marked as complete. This provides full control over recognition timing based on actual delivery. Example: $45,000 project with 2 milestones- Milestone 1 completion: $10,000 recognized

- Milestone 2 completion: $35,000 recognized

Worked example: Custom development project with milestones

Worked example: Custom development project with milestones

Scenario

- Product: Custom software development

- Amount: $45,000 total project fee

- Billing: Invoiced upfront on contract signing

- Invoice date: January 15, 2025

- Service period: January 15 - June 15, 2025

- Milestones:

- Milestone 1: Requirements analysis ($10,000)

- Milestone 2: Development and deployment ($35,000)

-

On invoice date (January 15th): Full amount deferred until milestones complete

- Journal: Debit Billed Revenue (+$45,000), Credit Deferred Revenue (+$45,000)

-

Milestone 1 completed (March 1st): First milestone revenue recognized

- Journal: Debit Deferred Revenue (-$10,000), Credit Recognized Revenue (+$10,000)

- Remaining deferred: $35,000

-

Milestone 2 completed (May 15th): Final milestone revenue recognized

- Journal: Debit Deferred Revenue (-$35,000), Credit Recognized Revenue (+$35,000)

- Project complete: $45,000 total recognized

Milestone recognition provides complete control over revenue timing, ensuring recognition only occurs when specific deliverables are actually completed.

Milestone recognition workflow

-

On invoice date: Revenue is deferred (regardless of billing timing)

- Debit: Billed Revenue (+$45,000)

- Credit: Deferred Revenue (+$45,000)

-

When milestone is marked complete: Revenue is recognized

- Milestone 1: Debit Deferred Revenue (-$10,000), Credit Recognized Revenue (+$10,000)

- Milestone 2: Debit Deferred Revenue (-$35,000), Credit Recognized Revenue (+$35,000)

Choosing the right recognition method

| Scenario | Recommended Method | Reason |

|---|---|---|

| Monthly SaaS subscription | Straight-line | Consistent value delivery over time |

| API usage billing | Usage-based | Value varies with consumption |

| Setup/onboarding fee | Point-in-time | Value delivered at specific moment |

| Custom development project | Milestone | Value tied to specific deliverables |

| Annual license (paid upfront) | Straight-line | Consistent access over license period |

| Data processing charges | Usage-based | Value based on volume processed |