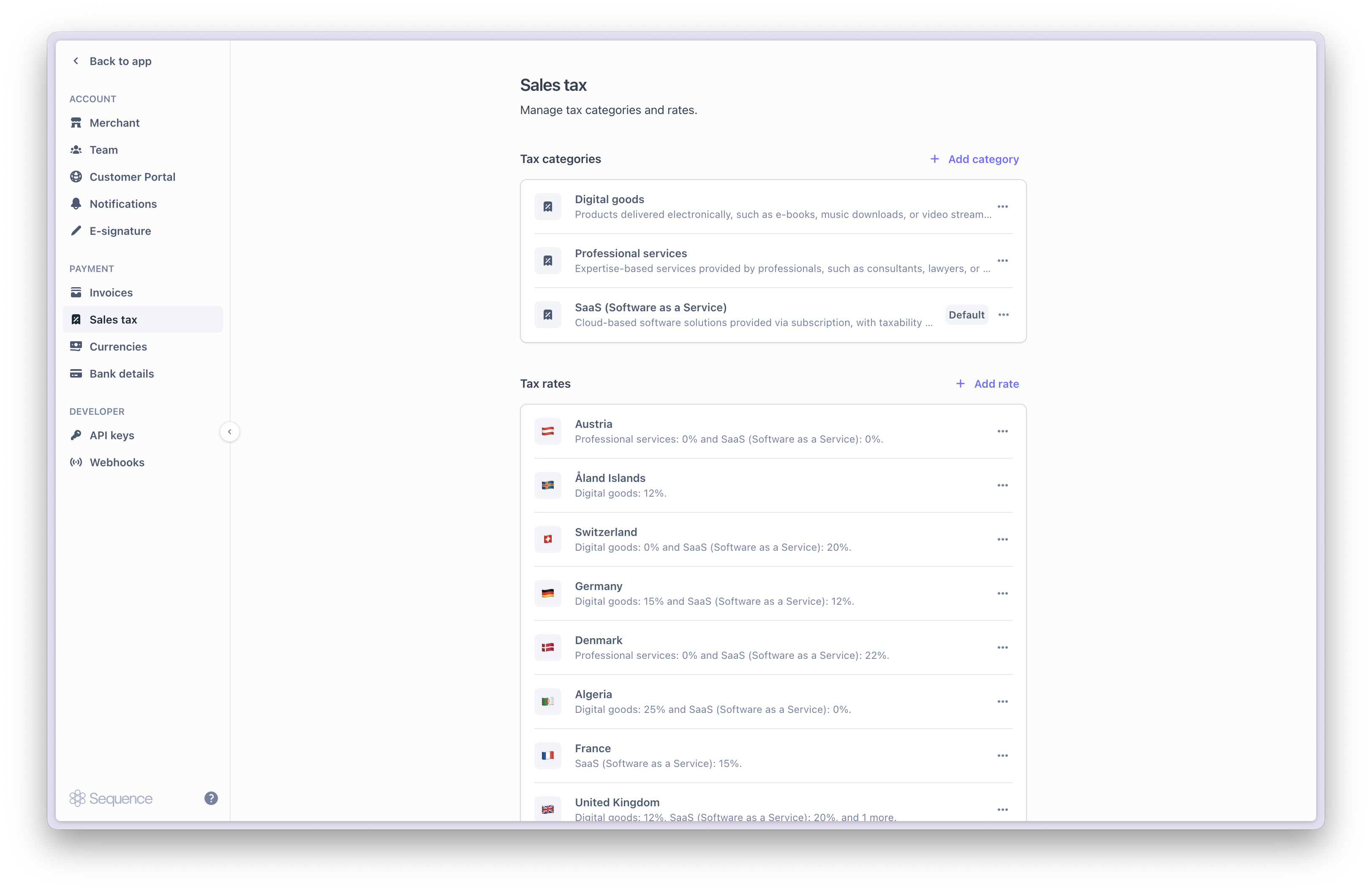

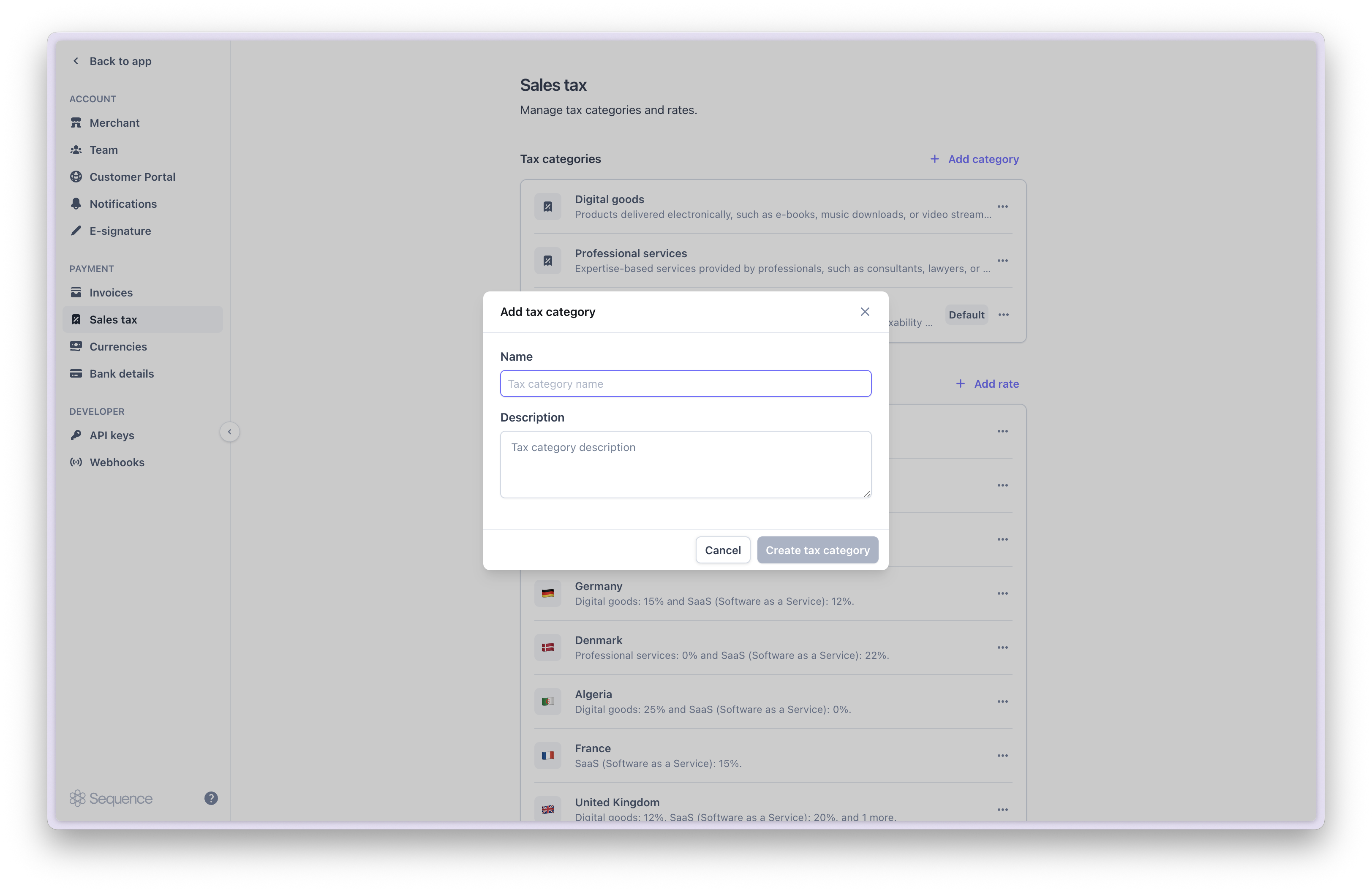

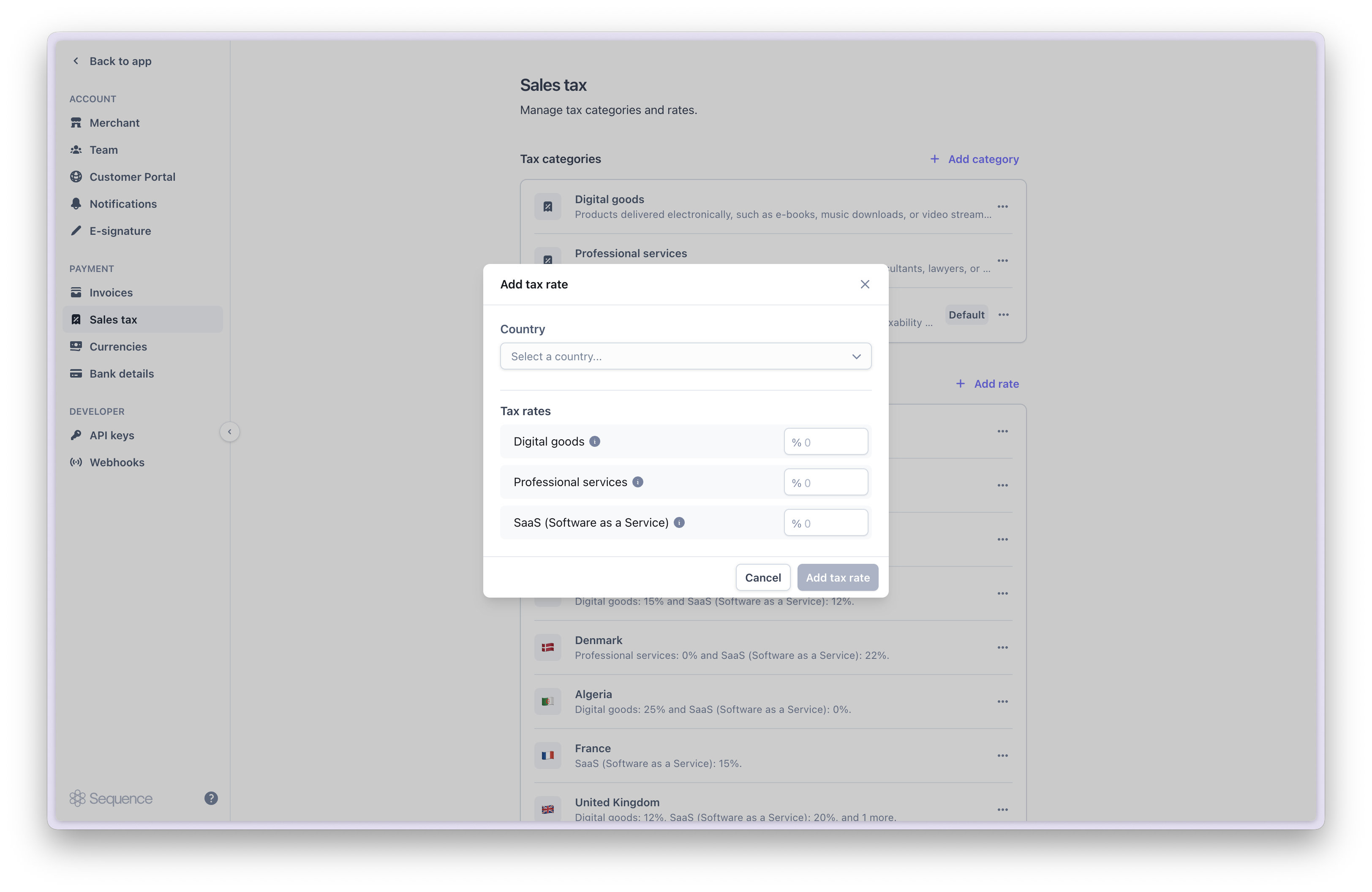

Create and manage tax categories

Go to Settings > Sales tax to manage tax categories and tax rates.

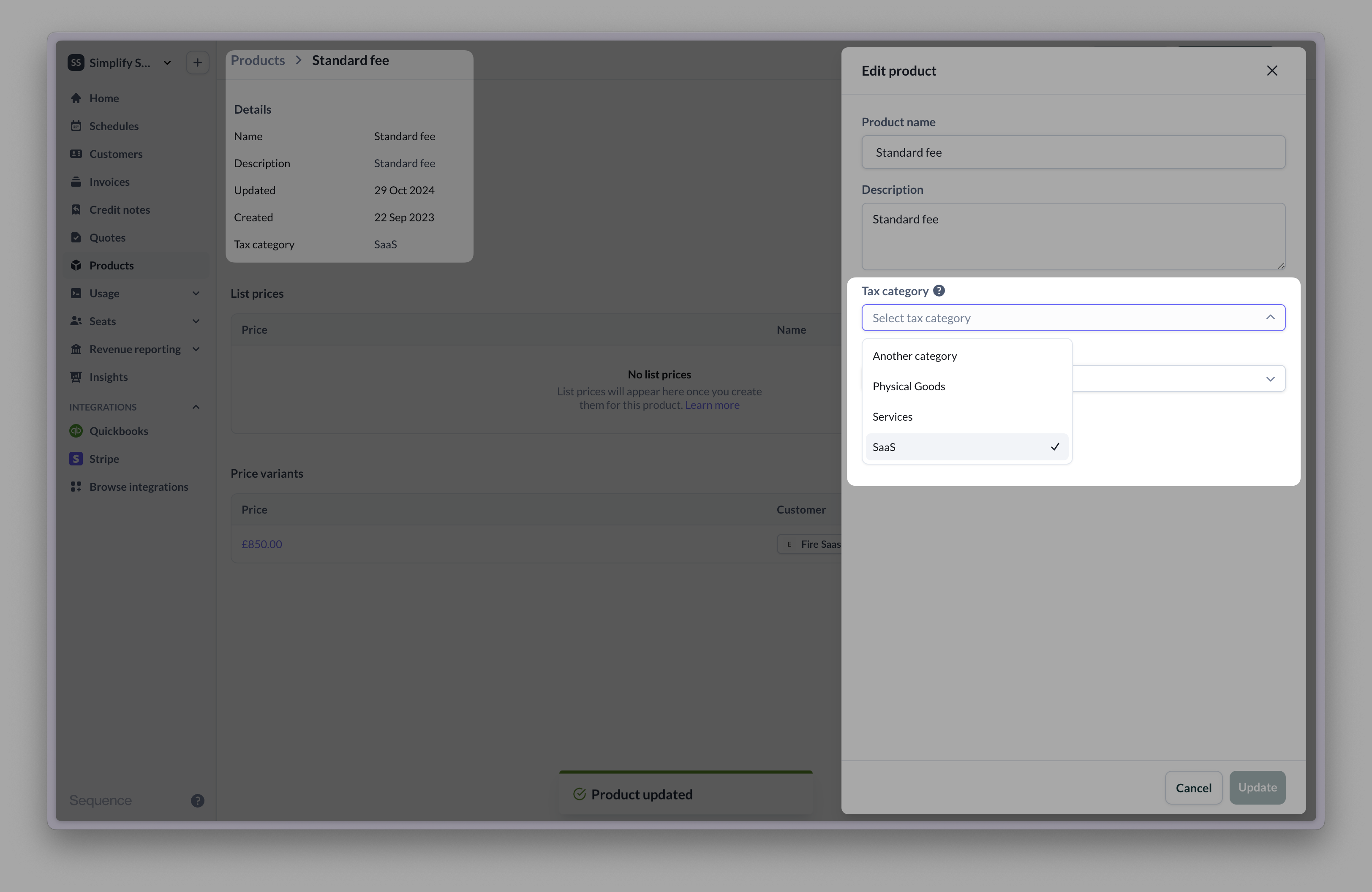

Assigning or updating product tax categories

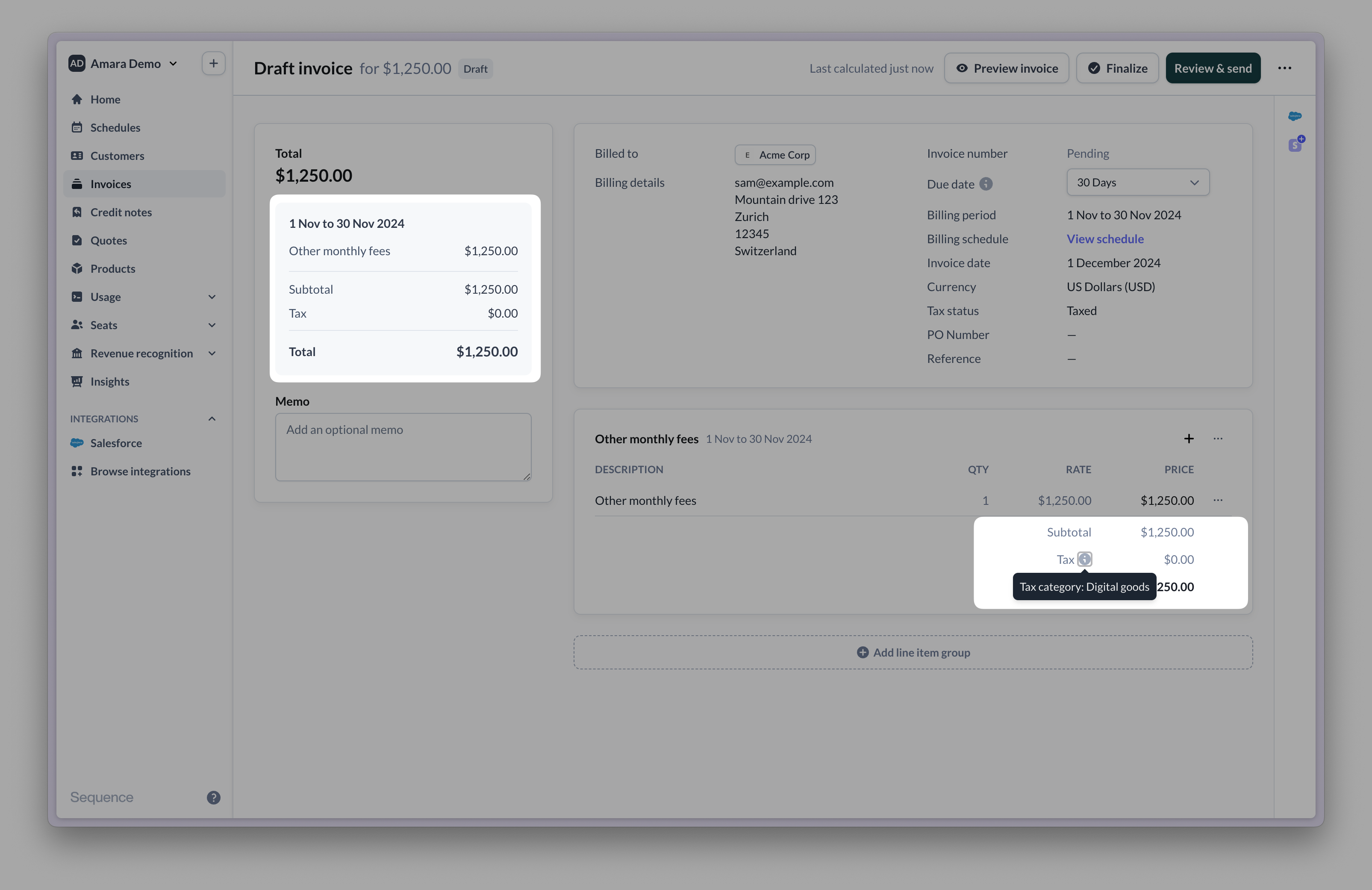

Go to the product catalog and a select a product to update its tax category. You need to recalculate draft invoices for product tax category updates to take effect.

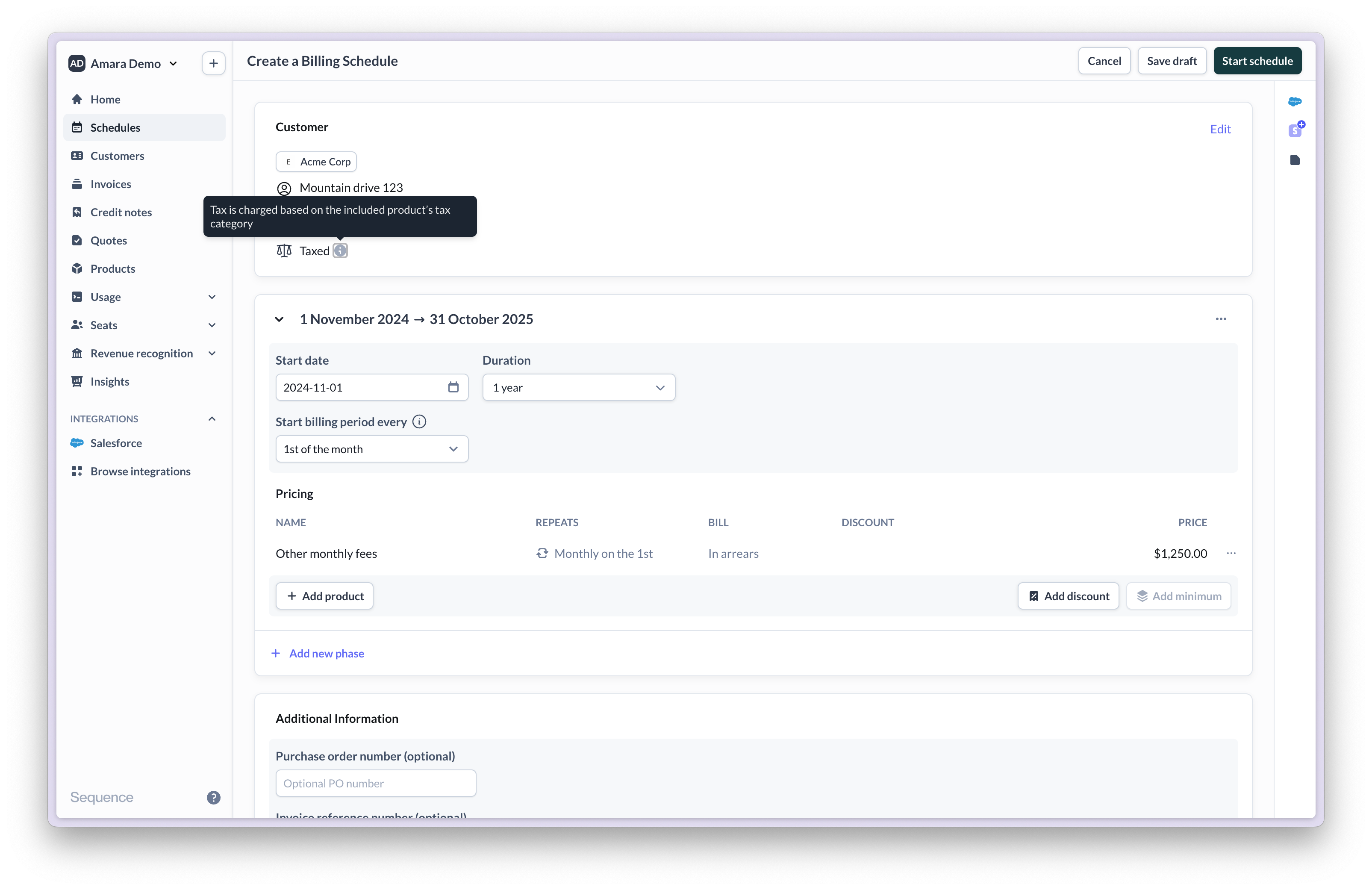

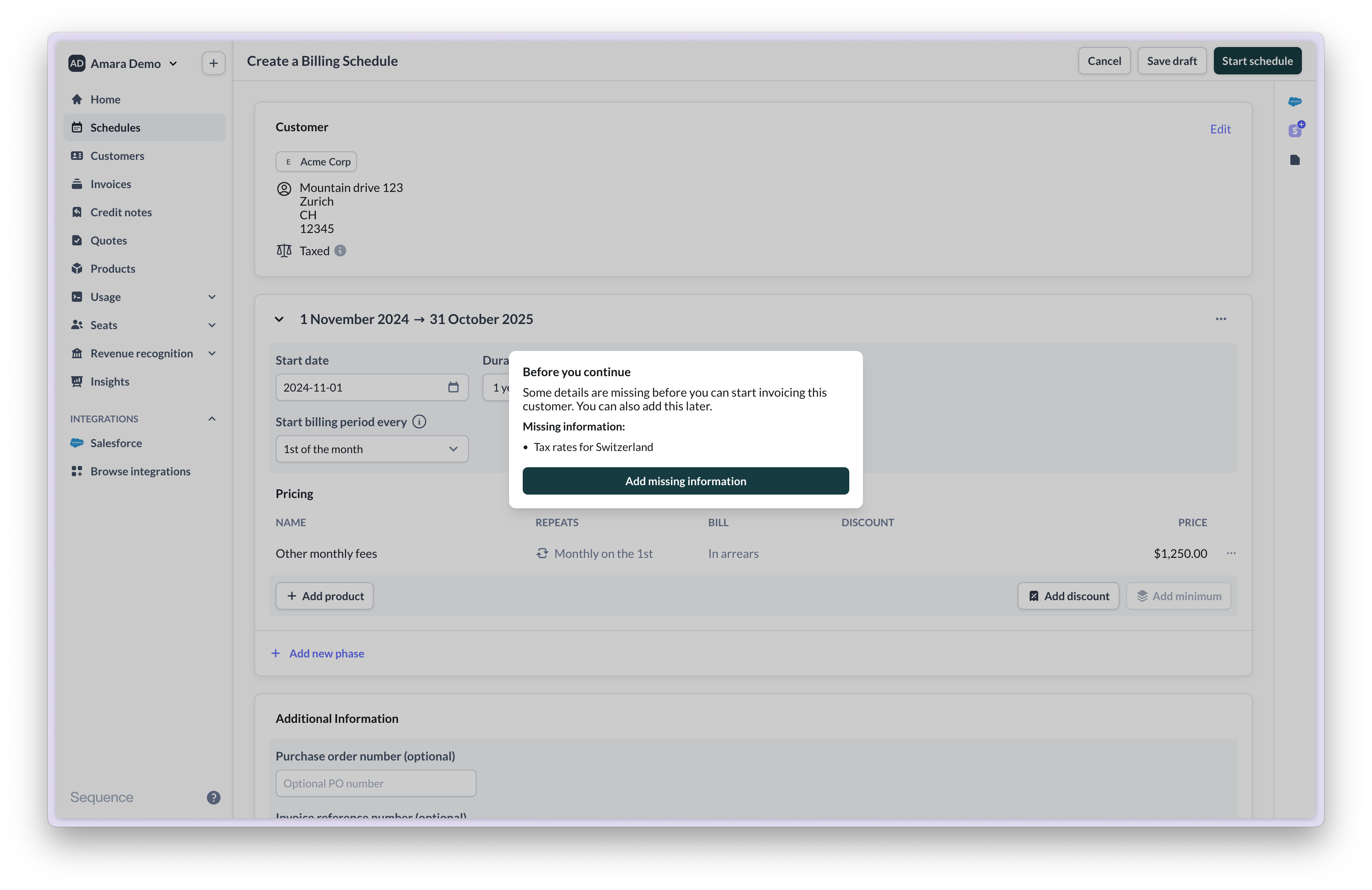

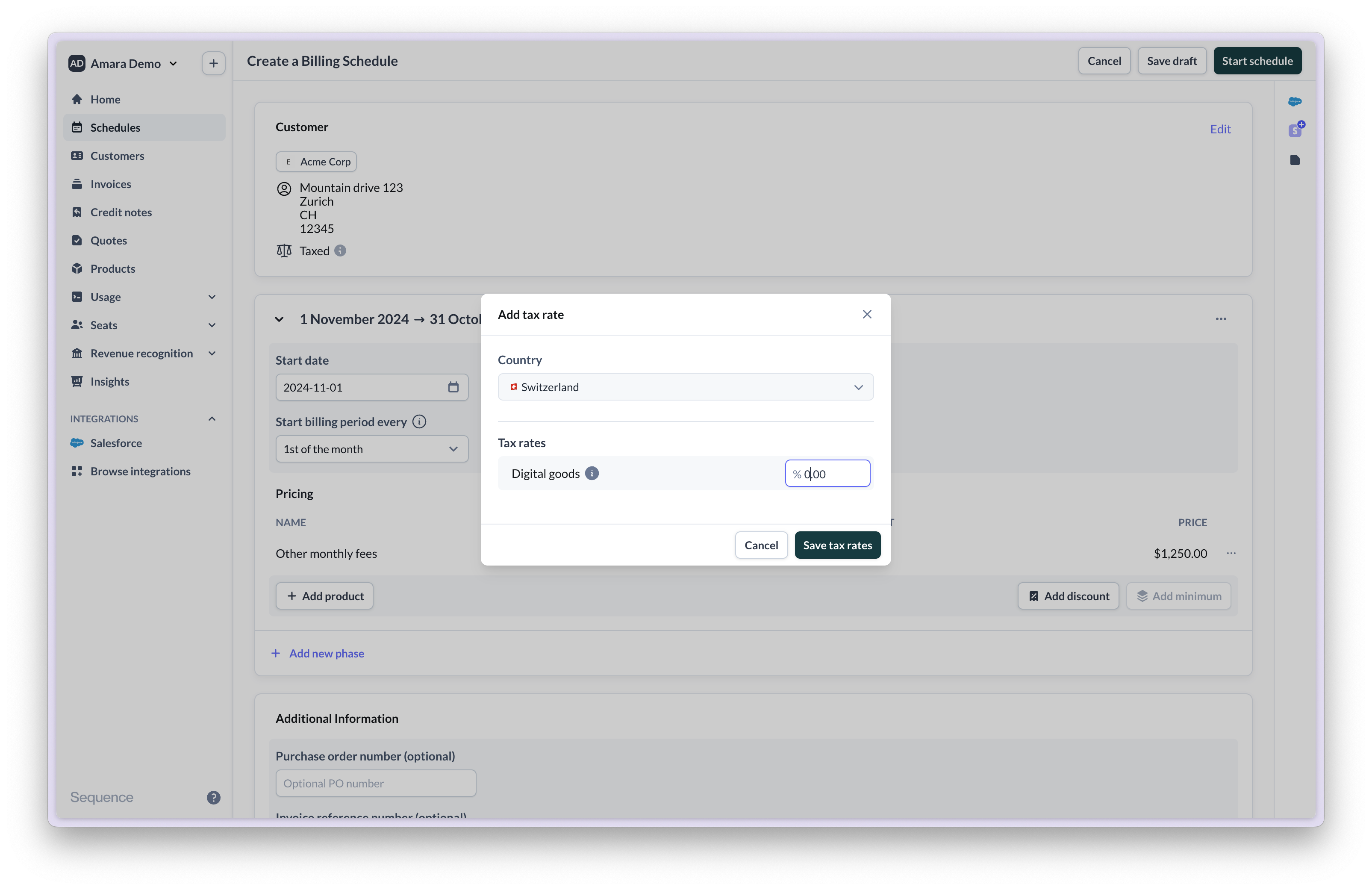

Charging sales tax

When you create a billing schedule for a taxed customer, Sequence will look up whether you have provided tax rates for the customer’s region.

Frequently asked questions (FAQ)

How do I configure a 0% tax rate for a customer?

How do I configure a 0% tax rate for a customer?

You can either mark the customer as tax exempt, or set up a 0% tax rate for the customer’s country in the product’s tax category.

How can I display my company's Tax or VAT ID on invoices?

How can I display my company's Tax or VAT ID on invoices?

Please get in touch with a member of the team.

How can I display my customer's Tax or VAT ID on invoices?

How can I display my customer's Tax or VAT ID on invoices?

Go to the customer’s page in Sequence and select

Edit, then add a tax ID. You will need to recalculate any draft or upcoming invoices for changes to reflect.How do I update a tax rate?

How do I update a tax rate?

Go to Settings > Sales tax. Select the tax rate or category you want to update. You will need to recalculate any draft or upcoming invoices for changes to reflect.

How do I change the tax status of a customer?

How do I change the tax status of a customer?

Go to the customer’s page in Sequence and select

Edit, then update the customer’s tax status. You will need to recalculate any draft or upcoming invoices for changes to reflect.How can I calculate sales tax automatically (e.g. in the US)?

How can I calculate sales tax automatically (e.g. in the US)?

To automatically calculates sales tax, use the Avalara sales tax integration.

How is tax handled on credit notes?

How is tax handled on credit notes?

When you create a credit note for an invoice, each credit line inherits the tax rate present on the original invoice. If you create a credit note from scratch, you need to provide a tax rate for each credit line.